Buyer (And Seller) Beware. Is housing set to blow, or are there more gains ahead? Here's how to navigate an anxious market. Confused about the direction of the housing market? It's no wonder. You hear stories about sellers slashing listing prices to attract buyers, but home prices nationally have risen more than 10% over the past year. Inventories of unsold homes are on the rise, yet homebuilder Lennar Corp. just reported a 34% jump in earnings. And the much feared rise in 30-year mortgage rates seems to have stalled. Click here to read more.

For Sale Signs Rise, Home Sellers Cut Prices as Fed Tightens. Sales of new homes fell 10.5 percent in February, the biggest drop since 1995, and sales of existing homes slipped in five of the last six months, leaving a record 3 million unsold houses on the market. Sales will fall further this year and price gains will slow, predicts the Washington-based National Association of Realtors. High-end properties and markets that had the biggest increases during the boom are cooling the most. Entry-level buyers are still strong, while buyers looking to step up to bigger houses are becoming more cautious. Click here to read more.

Boom-market casualties. Cost skyrockets for moving people out of a life on the streets. Sky-high real estate prices are making things hard for more than just first-time home buyers -- they're hampering efforts by groups seeking to house the long-term homeless. Social service officials throughout the Inland area and California are trying to comply with federal and state mandates to provide subsidized apartments or houses for the chronically homeless -- those who have been on the streets for a year or more or suffer from disabling conditions such as mental illness and substance abuse. But record-high property prices and competition from commercial developers are making that difficult even for nonprofit organizations that have millions in government funding to spend. Inland land costs average $125,000 per acre, according to Steve Johnson, director of Metro Study in Riverside, a consulting firm. New home prices are rising at an annual rate of 28 percent in San Bernardino County and 10 percent in Riverside County, according to DataQuick Information Systems, a company that tracks housing trends. Apartment rents are expected to rise another 5 percent this year. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Southern California Inland Empire real estate market trends and updates.

Realtor Tina Jan helps Southern California home buyers and sellers. Her market area is Beaumont, Banning, Cherry Valley, Yucaipa, Calimesa, San Jacinto, Hemet, Redlands, Loma Linda, Riverside, Moreno Valley, Fontana, Highland, Rancho Cucamonga, Upland, and other local Inland Empire cities.

Friday, March 31, 2006

Thursday, March 30, 2006

Real Estate News for Thursday, March 30th, 2006

Report: Inland Empire rents to rise. Apartment rents, already high in the Southland, will even get higher. Occupancy rates, already among the highest in the country, will increase, too. That's the conclusion of the Casden Real Estate Economics Forecast that's out today from the Lusk Center for Real Estate at USC. There are too many people and not enough apartments, so prices will continue rising. In the Inland Empire in particular, rents are expected to rise by an average of 5 percent this year on the heels of a 4.7 percent hike in 2005. Blame it on the overheated housing market, said Delores Conway, director of the Casden Forecast. Click here to read more.

Inland Empire serves as bright spot in report. The six major Southern California counties have more manufacturing jobs than any other state in the nation, according to a report released Wednesday. Riverside, San Bernardino and Ventura counties will add 500 jobs this year, Kyser said. Los Angeles, Orange and San Diego counties are expected to lose 6,500 manufacturing jobs this year, he said. Cheaper land and the ability to accommodate expanding manufacturing companies has allowed Riverside and San Bernardino counties to add manufacturing jobs, Kyser said. Click here to read more.

Target will soon open its first California Super Target in Moreno Valley. In addition, two of the nation's most popular stores may open new outlets in Ontario. The city is considering a proposal for a 250,000-square-foot shopping center on Fourth Street near Milliken Avenue that would be anchored by both a Target and a Best Buy store. Ontario's recent history with big-box retailers such as Target and Best Buy is less than stellar. Fry's Electronics was poised to build a store on a 19-acre site in the city in 2004, but the deal fell apart when the city wanted architectural changes to the proposed building that the store didn't want to pay for. Also, a proposal to bring a Wal-Mart Supercenter to a site on Mountain Avenue (once occupied by another Target store) has run into entrenched community opposition. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Inland Empire serves as bright spot in report. The six major Southern California counties have more manufacturing jobs than any other state in the nation, according to a report released Wednesday. Riverside, San Bernardino and Ventura counties will add 500 jobs this year, Kyser said. Los Angeles, Orange and San Diego counties are expected to lose 6,500 manufacturing jobs this year, he said. Cheaper land and the ability to accommodate expanding manufacturing companies has allowed Riverside and San Bernardino counties to add manufacturing jobs, Kyser said. Click here to read more.

Target will soon open its first California Super Target in Moreno Valley. In addition, two of the nation's most popular stores may open new outlets in Ontario. The city is considering a proposal for a 250,000-square-foot shopping center on Fourth Street near Milliken Avenue that would be anchored by both a Target and a Best Buy store. Ontario's recent history with big-box retailers such as Target and Best Buy is less than stellar. Fry's Electronics was poised to build a store on a 19-acre site in the city in 2004, but the deal fell apart when the city wanted architectural changes to the proposed building that the store didn't want to pay for. Also, a proposal to bring a Wal-Mart Supercenter to a site on Mountain Avenue (once occupied by another Target store) has run into entrenched community opposition. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, March 29, 2006

Real Estate News for March 29th, 2006

Spring home buying season -- old rules, new tools. Here's how to put yourself in the best position as you start eyeing homes. It's that time of year again: After the long, cold winter, when shopping for new homes grinds nearly to a halt, the warm weather brings people out and into real estate offices. But this year, shoppers face a changed environment. In January 2005, only 382,000 homes were sold, according to the National Association of Realtors (NAR). By contrast, the peak sales month, June, saw 753,000 homes change hands, with much of the shopping coming in the two months prior. Now, many markets have cooled, giving more leverage to buyers. Still, it's more important than ever for shoppers to pay attention to fundamentals, and at the same time, there are new tools available to help.

Spring home buying season -- old rules, new tools. Here's how to put yourself in the best position as you start eyeing homes. It's that time of year again: After the long, cold winter, when shopping for new homes grinds nearly to a halt, the warm weather brings people out and into real estate offices. But this year, shoppers face a changed environment. In January 2005, only 382,000 homes were sold, according to the National Association of Realtors (NAR). By contrast, the peak sales month, June, saw 753,000 homes change hands, with much of the shopping coming in the two months prior. Now, many markets have cooled, giving more leverage to buyers. Still, it's more important than ever for shoppers to pay attention to fundamentals, and at the same time, there are new tools available to help.1) Get pre-approved for your loan.

2) Determine how much you can afford.

3) Don't get caught up in a bidding war.

4) Check out the home thoroughly before going to contract.

5) Pick your sales agent carefully.

Click here to read more.

California real estate slowdown will drag economy. UCLA forecast also projects national economic lull. A slowing real estate market in California will hurt the state's economy, according to the University of California, Los Angeles, economic forecast. The UCLA Anderson Forecast, which also reports on national and local expectations, projects that 200,000 jobs will likely be lost in California's construction sector "as residential construction and remodeling slow markedly," according to an announcement today. Click here to read more.

O.C. 3rd in nation for millionaires. Research shows county has 113,000 such households, not including homes. Orange County is home to 113,000 households with a net worth of $1 million, ranking third nationally behind Los Angeles and Cook counties, said a report released Tuesday by TNS Financial Services. The Affluent Market Research Program report by TNS, a British financial-research firm, estimated the total number of millionaires jumped to 8.9 million nationwide in 2005, an 8 percent increase over 2004. The number of millionaires increased for the third consecutive year in the study, which is based on a national survey of 1,800 households with a net worth of $500,000 or more, excluding their homes. TNS reported that the number of Orange County millionaires was 80,200 in 2003 and 107,028 in 2004. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Tuesday, March 28, 2006

Real Estate News for Tuesday, March 28th, 2006

AREAA Launches New Asian-American Housing Education and Certification Course; The First AREAA Certification Course is Approved for Continuing Education Credit by California Department of Real Estate. Practitioners will learn the following:

-- Dynamics of the Asian-Pacific American Market

-- Understanding the Asian-Pacific American Housing Market

-- Leading Barriers to Homeownership in this market

-- How to best serve with the Asian-American population during real estate transactions

-- Basic Dos and Don'ts related to interacting with the Asian-American housing market

-- Case studies to help real estate practitioners better prepare to support this market

Contact AREAA Representative: Daliah Acosta at (858)342-0001 if you are interested in this course. I know I would love to take it! Click here to read more.

Selling a Home: Should you have an Open House? The National Association of Realtors polled agents and found that open houses led to only 7 percent of all home sales. Referrals were sited as the biggest sales factor at 29% of all sales. In a 2005 profile of Home Buyers and Sellers, also conducted by the NAR, 42% of home buyers found open houses to be "Very Useful" as an information source and 55% said they used open houses as an information source in their search but of the nine categories in the chart showing where buyers first learned about the home they purchased, open houses were not even listed. Click here to read more.

Top 10 millionaire counties. The number of millionaires rose to a record level in 2005, and more than 1.1 million of them can be found in just 10 counties. The number of American millionaires rose to a record level last year, and they're disproportionately located in four counties in California, according to an analysis released Tuesday. Other states with counties that boast the highest number of millionaires across the country are Illinois, Arizona, Texas, New York, Florida and Massachusetts. The firm's survey found that the millionaire households had an average net worth, excluding principal residence, of nearly $2.2 million, of which more than $1.4 million was in liquid, or investable, assets. Their overall debt levels, meanwhile, fell by 8 percent, from $179,000 to $165,000. Who's heading these households? TNS found the median age of the head of millionaire households is 58, and 45 percent are retired. Roughly 19 percent own in whole or part a professional practice or privately held business. Over 50 percent of the millionaires surveyed said they had become more conservative in their investment approach over the past year. Their wealth is the result of long-term wealth accumulation. Although real estate is not their sole source of wealth, it remains a staple for many. Forty-six percent of those surveyed own investment real estate like a second home or rental properties. Seventy percent of the households, meanwhile, owned stocks and bonds, and 68 percent owned mutual funds. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

-- Dynamics of the Asian-Pacific American Market

-- Understanding the Asian-Pacific American Housing Market

-- Leading Barriers to Homeownership in this market

-- How to best serve with the Asian-American population during real estate transactions

-- Basic Dos and Don'ts related to interacting with the Asian-American housing market

-- Case studies to help real estate practitioners better prepare to support this market

Contact AREAA Representative: Daliah Acosta at (858)342-0001 if you are interested in this course. I know I would love to take it! Click here to read more.

Selling a Home: Should you have an Open House? The National Association of Realtors polled agents and found that open houses led to only 7 percent of all home sales. Referrals were sited as the biggest sales factor at 29% of all sales. In a 2005 profile of Home Buyers and Sellers, also conducted by the NAR, 42% of home buyers found open houses to be "Very Useful" as an information source and 55% said they used open houses as an information source in their search but of the nine categories in the chart showing where buyers first learned about the home they purchased, open houses were not even listed. Click here to read more.

Top 10 millionaire counties. The number of millionaires rose to a record level in 2005, and more than 1.1 million of them can be found in just 10 counties. The number of American millionaires rose to a record level last year, and they're disproportionately located in four counties in California, according to an analysis released Tuesday. Other states with counties that boast the highest number of millionaires across the country are Illinois, Arizona, Texas, New York, Florida and Massachusetts. The firm's survey found that the millionaire households had an average net worth, excluding principal residence, of nearly $2.2 million, of which more than $1.4 million was in liquid, or investable, assets. Their overall debt levels, meanwhile, fell by 8 percent, from $179,000 to $165,000. Who's heading these households? TNS found the median age of the head of millionaire households is 58, and 45 percent are retired. Roughly 19 percent own in whole or part a professional practice or privately held business. Over 50 percent of the millionaires surveyed said they had become more conservative in their investment approach over the past year. Their wealth is the result of long-term wealth accumulation. Although real estate is not their sole source of wealth, it remains a staple for many. Forty-six percent of those surveyed own investment real estate like a second home or rental properties. Seventy percent of the households, meanwhile, owned stocks and bonds, and 68 percent owned mutual funds. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Monday, March 27, 2006

Real Estate News for Monday, March 27th, 2006

Foreclosure Fraud Finds a Home. The crime that preys on strapped mortgage holders is on the rise in the Southland and elsewhere. Foreclosure fraud is a relatively simple crime. Once a property owner misses two or three monthly payments, a lender routinely files a notice of default with the county recorder's office. That public document is a precursor to formal foreclosure, and all a scam artist has to do to find victims is read the notices, descend on the homeowners and trick them into signing over title to their homes. It is a crime that consumer advocates fear could become increasingly common — especially in Southern California, where many homeowners have stretched themselves to their financial limits to afford the region's record high housing prices. Click here to read more.

REAL ESTATE: Realty Q&A. Private mortgage insurance and insurance risk scoring. PMI stands for private mortgage insurance, which is provided by private insurance carriers. The FHA, or Federal Housing Administration, is Uncle Sam's version of a private insurer. It insures loans, typically the ones the private guys don't want to cover, made by private lenders. In both cases, the premiums are paid by borrowers, but the insurance protects lenders in case borrowers default on their payments. For any condo loan and the few rehabilitation mortgages that were made during the time the mortgage insurance premium was not collected upfront at closing -- pre-2006 -- you pay a monthly premium for the life of the loan. Realize, however, that the premium declines as the mortgage amortizes. That is, the amount you pay for FHA insurance is reduced each year as the balance on the mortgage declines.

But yes, since you will continue to pay and pay and pay some more, it may be a good idea to pay the loan off sooner rather than later, or to dump the loan altogether and replace it with another one with perhaps a lower rate and no mortgage insurance at all. Click here to read more.

NAR Asks Home Owners: If You Sell It, Will Buyers Come? Home owners who try to sell their home without professional help must overcome a number of hurdles. As mentioned in the TV spots, the obstacles include making the appropriate disclosures, preparing the home for sale, pricing the home appropriately for a dynamic market and, most importantly, attracting qualified, motivated buyers. According to the 2005 NAR Profile of Home Buyers and Sellers, only 17 percent of do-it-yourself home sellers used the Internet to market their home; that's at a time when Internet use in home searches has risen dramatically - in 2005, 77 percent of all home buyers used the Internet to look for a home. Finding an interested buyer is only the first step toward a successful sale. The typical home sale today involves more than 20 steps after the initial contract is accepted to complete the transaction. Consumers can learn more about potential post- contract pitfalls by visiting "http://www.realtor.org/realtororg.nsf/pages/post_contract _pitfalls". Most home sellers in today's market recognize the hazards inherent in do-it-yourself home selling, and rely on the expertise of a real estate professional to assist them when they sell their home. The percentage of owners who sell without representation has been trending down and is now at a record low - according to the 2005 profile, only 13 percent of recent home sellers sold their home without professional help, and only half of those would do it again. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

REAL ESTATE: Realty Q&A. Private mortgage insurance and insurance risk scoring. PMI stands for private mortgage insurance, which is provided by private insurance carriers. The FHA, or Federal Housing Administration, is Uncle Sam's version of a private insurer. It insures loans, typically the ones the private guys don't want to cover, made by private lenders. In both cases, the premiums are paid by borrowers, but the insurance protects lenders in case borrowers default on their payments. For any condo loan and the few rehabilitation mortgages that were made during the time the mortgage insurance premium was not collected upfront at closing -- pre-2006 -- you pay a monthly premium for the life of the loan. Realize, however, that the premium declines as the mortgage amortizes. That is, the amount you pay for FHA insurance is reduced each year as the balance on the mortgage declines.

But yes, since you will continue to pay and pay and pay some more, it may be a good idea to pay the loan off sooner rather than later, or to dump the loan altogether and replace it with another one with perhaps a lower rate and no mortgage insurance at all. Click here to read more.

NAR Asks Home Owners: If You Sell It, Will Buyers Come? Home owners who try to sell their home without professional help must overcome a number of hurdles. As mentioned in the TV spots, the obstacles include making the appropriate disclosures, preparing the home for sale, pricing the home appropriately for a dynamic market and, most importantly, attracting qualified, motivated buyers. According to the 2005 NAR Profile of Home Buyers and Sellers, only 17 percent of do-it-yourself home sellers used the Internet to market their home; that's at a time when Internet use in home searches has risen dramatically - in 2005, 77 percent of all home buyers used the Internet to look for a home. Finding an interested buyer is only the first step toward a successful sale. The typical home sale today involves more than 20 steps after the initial contract is accepted to complete the transaction. Consumers can learn more about potential post- contract pitfalls by visiting "http://www.realtor.org/realtororg.nsf/pages/post_contract _pitfalls". Most home sellers in today's market recognize the hazards inherent in do-it-yourself home selling, and rely on the expertise of a real estate professional to assist them when they sell their home. The percentage of owners who sell without representation has been trending down and is now at a record low - according to the 2005 profile, only 13 percent of recent home sellers sold their home without professional help, and only half of those would do it again. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Sunday, March 26, 2006

Real Estate News for Sunday, March 26th, 2006

How Buyers and Sellers Can Take Advantage of a Real Estate Market With High Sales and High Inventory. Prices have leveled off somewhat and inventory is abundant. The best time to buy is now, because negotiation is acceptable and deals can be found - this was unheard of last year! You can sell now if you like, but real estate is a long-term investment, it's not an equity product. Keep that in mind. Holding it long-term is the best strategy, unless you have some sort of Trump-like designs on it, and plan on re-development of a property or developing new. In that case, it is best to hold it short-term and sell quickly for a profit. Otherwise, buy, rent it out, and sell it later for a profit. Click here to read more.

The bid whisperers. It's no secret. Under a new rule, Realtors must tell their clients that their offers might be leaked to other buyers. Effective Jan. 1 of this year, buyers' agents in all member states, including California, are required to inform clients that their offers might not be kept confidential. Although many home buyers may not realize it, the terms of the offers they make may be revealed to other clients in a practice that the real estate industry commonly refers to as "shopping offers." And although many Realtors purport to find the practice distasteful or even unethical, others point out that negotiation styles and markets differ. Click here to read more.

What people are saying about Palm Springs? Canada's National Post earlier this month proclaimed, "Twentynine Palms may be the next Palm Springs," citing 360 days of sunshine, a booming real estate market with values that have shot up an average of 105 percent and a location that makes it too far for LA commuters but close enough for easy weekend getaways to the coast. Click here to read more.

REALTY MAILBAG: Paint the house inside and out and sell it `as is' When a home is sold ''as is,'' that means the seller must disclose all known defects (such as a leaking roof) but the seller won't pay for any repairs. However, if an obvious defect can be repaired at minimal expense, such as a dripping faucet, get it fixed. After the house is painted and ready to sell, I suggest you interview at least two more realty agents. You need to compare their evaluations, especially their CMAs (comparative market analysis). These forms will show you recent sales prices of comparable nearby homes, asking prices of neighborhood homes currently listed for sale (your competition), and even the asking prices of recently expired similar home listings. Then you can correctly set your asking price. Click here to read more.

New shopping center in Palm Springs may break ground by summer. A major national arts and crafts retailer will soon be located at an 18-acre destination shopping center that could break ground in about three months at the corner of Barona Road and East Palm Canyon Drive. Click here to read more.

Consumer Action: Buying in a Cooling Market. BUYING A HOME IS always nerve-wracking. After all, it's the largest purchase most folks will ever make. But it becomes downright ulcer-inducing when water cooler talk shifts from skyrocketing home values to grim speculations about real estate bubbles. It doesn't help matters that home sales numbers are as moody as a celebrity marriage. According to data released by the Commerce Department Friday, sales of new single-family homes fell 10.5% to a seasonally adjusted annual rate of 1.08 million since January. At the same time, a report on existing home sales data for February released a day earlier by the National Association of Realtors (NAR) showed a 5.2% increase in sales over January. So is the market cooling, or is it picking back up? According to experts, it's moving from a full-on boil to a simmer. Click here to read more.

Bubble, schmubble: Market still hot, hot, hot in desert. Houses, however, are vastly different. Not only are they physically anchored to a particular piece of ground, but they come in different sizes, designs, amenities, heights, shapes and are built from a variety of materials. Houses really can't be bought and sold in seconds. The typical transaction is more like weeks to months to get in and out of an escrow. You also can have input into how the houses around yours are maintained and used. That just simply doesn't happen with stock investments in companies run by others - unless of course, you control most of the stock. For statistical and comparable reasons, we often lump many small housing markets together and call those larger regional or statewide pieces a housing market. Nationally, we add everything together and call is a national housing market. But in truth, those are really just smaller individual sectors acting independently. Markets do ebb and flow; and sometimes that ebb and flow can look a lot more like a flood. Housing values and sales activity cycles - just like any business. If they didn't, we would not call them business "cycles" - we would call them business "flats." Click here to read more.

The Land of the Open House: Merced, once the state's hottest housing market, is headed back to being, well, Merced again. Last year, this Central Valley city enjoyed the state's hottest real estate market. After five increasingly wild years, the great real estate boom appears to be coming to a close. The Commerce Department reported Friday that sales of new homes nationwide plunged 10.5% in February, about five times the drop analysts predicted. In places such as Los Angeles, which have diverse economies, the consequences could be mild. In other communities, where prices became untethered from reality long ago and real estate not only drove the economy but virtually became the economy, the fallout could be much more turbulent. Merced — a farming town once known, if known at all, as a place campers turned off California 99 on their way to Yosemite National Park — is falling into the latter category. The good times have already ended here, in the same way slamming into a wall reduces your speed. A house will fetch 20% less today than it did last summer, brokers say, assuming it finds a buyer at all. Just a little while ago, Merced was an investor's dream. The Office of Federal Housing Enterprise Oversight reported this month that prices in the city and surrounding area increased 31% in 2005. The housing agency ranked Merced first in price appreciation in California and ninth in the nation. Click here to read more.

New-Home Sales Rise in Region: While the U.S. posts a 10.5% month-to-month fall, Southern California records a 9.5% gain. The latest evidence came Friday when the Commerce Department reported that the number of new single-family homes sold nationwide fell 10.5% last month from the month before, to an annual rate of 1.08 million units, marking the biggest drop in new-home sales in nearly nine years. The drop pushed a gauge of the volume of unsold new homes to its highest level in more than a decade. In February, 548,000 new homes went unsold, representing a 6.3-month supply — meaning it would take that long to sell them at current sales rates. In January, there was a 5.3-month supply. In the West, which includes California, the sales plunge was even worse: down 29.4%, partly reflecting stalling sales in Sacramento and the Central Valley and in other Western states such as Arizona. Yet in Southern California, sales of new single-family houses and condominiums saw their strongest February since 1988, according to statistics compiled by real estate research firm DataQuick Information Systems. Last month, sales rose 9.5% to 4,980 from January's 4,550, and were up 19% from the year before. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

The bid whisperers. It's no secret. Under a new rule, Realtors must tell their clients that their offers might be leaked to other buyers. Effective Jan. 1 of this year, buyers' agents in all member states, including California, are required to inform clients that their offers might not be kept confidential. Although many home buyers may not realize it, the terms of the offers they make may be revealed to other clients in a practice that the real estate industry commonly refers to as "shopping offers." And although many Realtors purport to find the practice distasteful or even unethical, others point out that negotiation styles and markets differ. Click here to read more.

What people are saying about Palm Springs? Canada's National Post earlier this month proclaimed, "Twentynine Palms may be the next Palm Springs," citing 360 days of sunshine, a booming real estate market with values that have shot up an average of 105 percent and a location that makes it too far for LA commuters but close enough for easy weekend getaways to the coast. Click here to read more.

REALTY MAILBAG: Paint the house inside and out and sell it `as is' When a home is sold ''as is,'' that means the seller must disclose all known defects (such as a leaking roof) but the seller won't pay for any repairs. However, if an obvious defect can be repaired at minimal expense, such as a dripping faucet, get it fixed. After the house is painted and ready to sell, I suggest you interview at least two more realty agents. You need to compare their evaluations, especially their CMAs (comparative market analysis). These forms will show you recent sales prices of comparable nearby homes, asking prices of neighborhood homes currently listed for sale (your competition), and even the asking prices of recently expired similar home listings. Then you can correctly set your asking price. Click here to read more.

New shopping center in Palm Springs may break ground by summer. A major national arts and crafts retailer will soon be located at an 18-acre destination shopping center that could break ground in about three months at the corner of Barona Road and East Palm Canyon Drive. Click here to read more.

Consumer Action: Buying in a Cooling Market. BUYING A HOME IS always nerve-wracking. After all, it's the largest purchase most folks will ever make. But it becomes downright ulcer-inducing when water cooler talk shifts from skyrocketing home values to grim speculations about real estate bubbles. It doesn't help matters that home sales numbers are as moody as a celebrity marriage. According to data released by the Commerce Department Friday, sales of new single-family homes fell 10.5% to a seasonally adjusted annual rate of 1.08 million since January. At the same time, a report on existing home sales data for February released a day earlier by the National Association of Realtors (NAR) showed a 5.2% increase in sales over January. So is the market cooling, or is it picking back up? According to experts, it's moving from a full-on boil to a simmer. Click here to read more.

Bubble, schmubble: Market still hot, hot, hot in desert. Houses, however, are vastly different. Not only are they physically anchored to a particular piece of ground, but they come in different sizes, designs, amenities, heights, shapes and are built from a variety of materials. Houses really can't be bought and sold in seconds. The typical transaction is more like weeks to months to get in and out of an escrow. You also can have input into how the houses around yours are maintained and used. That just simply doesn't happen with stock investments in companies run by others - unless of course, you control most of the stock. For statistical and comparable reasons, we often lump many small housing markets together and call those larger regional or statewide pieces a housing market. Nationally, we add everything together and call is a national housing market. But in truth, those are really just smaller individual sectors acting independently. Markets do ebb and flow; and sometimes that ebb and flow can look a lot more like a flood. Housing values and sales activity cycles - just like any business. If they didn't, we would not call them business "cycles" - we would call them business "flats." Click here to read more.

The Land of the Open House: Merced, once the state's hottest housing market, is headed back to being, well, Merced again. Last year, this Central Valley city enjoyed the state's hottest real estate market. After five increasingly wild years, the great real estate boom appears to be coming to a close. The Commerce Department reported Friday that sales of new homes nationwide plunged 10.5% in February, about five times the drop analysts predicted. In places such as Los Angeles, which have diverse economies, the consequences could be mild. In other communities, where prices became untethered from reality long ago and real estate not only drove the economy but virtually became the economy, the fallout could be much more turbulent. Merced — a farming town once known, if known at all, as a place campers turned off California 99 on their way to Yosemite National Park — is falling into the latter category. The good times have already ended here, in the same way slamming into a wall reduces your speed. A house will fetch 20% less today than it did last summer, brokers say, assuming it finds a buyer at all. Just a little while ago, Merced was an investor's dream. The Office of Federal Housing Enterprise Oversight reported this month that prices in the city and surrounding area increased 31% in 2005. The housing agency ranked Merced first in price appreciation in California and ninth in the nation. Click here to read more.

New-Home Sales Rise in Region: While the U.S. posts a 10.5% month-to-month fall, Southern California records a 9.5% gain. The latest evidence came Friday when the Commerce Department reported that the number of new single-family homes sold nationwide fell 10.5% last month from the month before, to an annual rate of 1.08 million units, marking the biggest drop in new-home sales in nearly nine years. The drop pushed a gauge of the volume of unsold new homes to its highest level in more than a decade. In February, 548,000 new homes went unsold, representing a 6.3-month supply — meaning it would take that long to sell them at current sales rates. In January, there was a 5.3-month supply. In the West, which includes California, the sales plunge was even worse: down 29.4%, partly reflecting stalling sales in Sacramento and the Central Valley and in other Western states such as Arizona. Yet in Southern California, sales of new single-family houses and condominiums saw their strongest February since 1988, according to statistics compiled by real estate research firm DataQuick Information Systems. Last month, sales rose 9.5% to 4,980 from January's 4,550, and were up 19% from the year before. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, March 23, 2006

Real Estate News for Thursday, March 23rd, 2006

California Realtors report bigger inventories, slower sales in February. There were more homes on the market than a year ago and it took longer to sell them in California in February, the state's Realtor Group said on Thursday. The California Association of Realtors said its unsold inventory index, which measures how many months it would take to sell the inventory of existing single-family homes, rose to 6.7 months in February from 6 months in January. The median number of days it took to sell a home increased to 52 days from 48 days in the first two months of the year, compared to 40 days in February 2005. Despite that, CAR also said that while the number of sales declined again in February, the pace of that drop slowed. The year-to-year drop in sales slowed to 15.5 percent in February, compared to a 24.1 percent decrease reported in January. The year-to-year increase in median price remained relatively steady, up 13.7 percent at $470,920. Click here to read more.

The Pro Shop. Investing for Dummies. Despite the title, "Investing for Dummies" isn't just for folks who think stuffing bills into a mattress is the best way to accumulate wealth. A primer for novices at its heart, it also gets meaty in parts. More complex subjects such as real-estate financing, understanding a company's annual report and buying into a small business are covered. The book is also meant to help fill gaps in the knowledge of more experienced investors — especially those who've realized they don't know as much as they thought they did. The common denominator: Novice and expert alike are looking for smart ways to build wealth. Click here to read more.

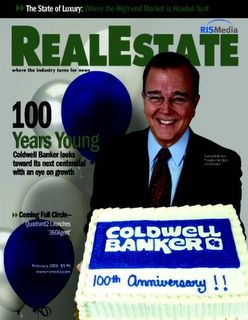

A Rich Market for Decadent Digs. Wealthy buyers are snapping up trophy homes at a record pace -- and now, they're looking beyond the sunny states. Coldwell Banker CEO Jim Gillespie notes this same trend of getting "the whole package." He recently told BusinessWeek Online that while "warm weather and the water remain primary draws…golf and ski resorts, cultural centers, shopping destinations, and other areas are seeing an influx of luxury homes." The gold rush is apparently sweeping not only California and perennial hot spot Florida, but Massachusetts, New Jersey, Illinois, Connecticut, Arizona, and New York as well. Each of these states racked up more than $1 billion in sales for Coldwell Banker luxury homes last year. In fact, Coldwell reported record luxury-home sales in the U.S., surging up to $55.9 billion in 2005 -- a 24% increase from the $45.2 billion record set in 2004. However, some say that appreciation of luxury houses in the $1 million to $2.5 million range will be flat in 2006, and may even decline in years to come. Baby-boomers may opt to downsize to a condominium or to age-restricted housing in 2006. Some may see the equities in their retirement funds and 401(k) plans erode, while others may devote more of their assets to a retirement home. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

The Pro Shop. Investing for Dummies. Despite the title, "Investing for Dummies" isn't just for folks who think stuffing bills into a mattress is the best way to accumulate wealth. A primer for novices at its heart, it also gets meaty in parts. More complex subjects such as real-estate financing, understanding a company's annual report and buying into a small business are covered. The book is also meant to help fill gaps in the knowledge of more experienced investors — especially those who've realized they don't know as much as they thought they did. The common denominator: Novice and expert alike are looking for smart ways to build wealth. Click here to read more.

A Rich Market for Decadent Digs. Wealthy buyers are snapping up trophy homes at a record pace -- and now, they're looking beyond the sunny states. Coldwell Banker CEO Jim Gillespie notes this same trend of getting "the whole package." He recently told BusinessWeek Online that while "warm weather and the water remain primary draws…golf and ski resorts, cultural centers, shopping destinations, and other areas are seeing an influx of luxury homes." The gold rush is apparently sweeping not only California and perennial hot spot Florida, but Massachusetts, New Jersey, Illinois, Connecticut, Arizona, and New York as well. Each of these states racked up more than $1 billion in sales for Coldwell Banker luxury homes last year. In fact, Coldwell reported record luxury-home sales in the U.S., surging up to $55.9 billion in 2005 -- a 24% increase from the $45.2 billion record set in 2004. However, some say that appreciation of luxury houses in the $1 million to $2.5 million range will be flat in 2006, and may even decline in years to come. Baby-boomers may opt to downsize to a condominium or to age-restricted housing in 2006. Some may see the equities in their retirement funds and 401(k) plans erode, while others may devote more of their assets to a retirement home. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, March 22, 2006

Real Estate News for Wednesday, March 22nd, 2006

Beaumont tops Pass districts in performance index. SCHOOLS: Yucaipa- Calimesa straddles the midpoint, while Banning looks for better results. Beaumont schools generally ranked in the upper half statewide in academic-performance rankings released Tuesday, with Yucaipa-Calimesa schools posting mixed results and Banning schools mostly populating the lower half. Every Beaumont comprehensive school except San Gorgonio Middle School ranked in the upper half statewide and among similar schools, the rankings showed. Yucaipa-Calimesa had schools ranked as high as 10 and as low as 3, while Banning's elementary schools far outpaced its middle and high schools. Beaumont's Chavez Elementary earned an 8 statewide and a 10 among similar schools, tying it with Yucaipa's Ninth Grade Campus for the highest combined ranking among Pass-area schools. "My reaction was 'Wow,' " Brenda Erby, Chavez's principal, said of her school's ranking. "It's always exciting to be commended on those efforts." While she didn't expect her school to rank so high, Erby said the school's staff has been "laser-focused" on tracking students' progress. Among comprehensive high schools, Beaumont High led the way with a 6 statewide and a 7 among similar schools. Beaumont High School parent Yvonne Morales said while the school still has room for improvement, she is pleased to see her son's school excel and commends its student-assistance resources. Click here to read more.

California State's Air Is Among Nation's Most Toxic. "Only New York has a higher risk of cancer caused by airborne chemicals, the EPA says. In the Los Angeles area, the cancer threat is much higher, 93 per million in Los Angeles County — or one person in every 10,700 — and 79 per million in Orange County. The national average is 41.5 per million: one in every 24,000 Americans. Riverside and San Bernardino counties are near the U.S. average." Well, what can I say? The air is just better over here in the Inland Empire! Click here to read more.

More Than 117,000 New Pre-Foreclosures and Foreclosures Reported. Georgia, Michigan, Indiana Post Highest Foreclosure Rates. February 2006 Monthly U.S. Foreclosure Market Report, which shows 117,259 properties nationwide entered some stage of foreclosure in February, a 13 percent increase from the previous month and a

More Than 117,000 New Pre-Foreclosures and Foreclosures Reported. Georgia, Michigan, Indiana Post Highest Foreclosure Rates. February 2006 Monthly U.S. Foreclosure Market Report, which shows 117,259 properties nationwide entered some stage of foreclosure in February, a 13 percent increase from the previous month and a

68 percent increase from February 2005. The report shows a February national

foreclosure rate of one new foreclosure for every 986 U.S. households. "This is the third straight month the U.S. foreclosure rate has moved higher, and it's the second straight month new foreclosures have topped 100,000," said James J. Saccacio, chief executive officer of RealtyTrac. "However, several states, including California, Florida, Texas and New York, reported a dip in foreclosures in February. We'll see if the rest of the country follows that trend in March." Click here to read more.

Barriers to Realty. As licensed real estate agents continue to flood into California's shaky housing market, industry experts and Realtors have questioned how standards can be maintained within the realty profession. A new bill, sponsored by the California Association of Realtors, aims to address some of the industry's concerns by forcing potential professionals to complete their required education before getting their license to buy and sell real estate -- instead of being issued a license before they've finished their classes, as is the current practice. Click here to read more.

Silicon Valley's Tech Revival Spurs Fever for Cashing in Options. For the first time in years, many Silicon Valley technology executives are seeing their stock options move into profitable territory, and they are cashing in at levels not seen since the end of the tech-stock boom in 2000. That's helping restore, for a while at least, a once-major source of wealth for the local economy and California's coffers. In just the past two years, Yahoo Inc. CEO Terry Semel has cashed in about $400 million in stock options. Incomes overall are up in the area. Multimillion-dollar homes are changing hands at a faster clip, real-estate agents say. And people are pouring more money into home remodeling. Click here to read more.

Gains in school rankings an 'A' for sales. HOMES: For both real-estate agents and developers, API results are often a selling point. The winners and losers of the Academic Performance Index released Tuesday include not only students, teachers and principals, but home builders, real-estate agents and private home sellers looking for buyers willing to pay a premium to live near a superior school. "I think you will find the test scores from high schools down to the elementary level are the most significant driver of real-estate values," said Steve Johnson, a director of Metro Study, a Riverside-based real-estate consulting firm. "I always thought if Californians ever figured out how significant a role schools play in the value of their real estate, they would get more involved in and supportive of schools, whether they have children in the local schools or not," he added. The Academic Performance Index, which rank schools statewide and among others with similar characteristics, can also influence home builders choosing locations for new subdivisions. "Before we buy land, we spend time looking at API scores," said Scott Laurie, president of KB Home Inland division. "We even have strategic maps where we have laid out the API scores by school district and down to each specific school." School administrators say they are aware of the impact of students' test scores on real-estate values. Click here to read more.

Google Base -- the next MLS? Real estate listings now searchable via Google. Google Base, a Web site where property listings and other information can be uploaded and displayed online for free, can now be searched via Google, giving rise to visions of the service as a possible "new MLS." It has always been possible to search Google Base itself, but consumers can now input phrases such as "Miami real estate" into Google's main search box and the results will show listings from Google Base. While countless Web sites now exist enabling consumers to search MLS property listings online, those sites often extract personal information from the searchers to be used as leads. Google Base, which launched in November, does not require such information. The product works somewhat similarly to craigslist, making it possible to quickly and easily create a free posting that will appear online and can be located by searching specific terms, such as "real estate for sale." Now, it's possible to find Google Base listings via Google itself. "This looks like Realtor.com Lite," opined Vince Malta, president of the California Association of Realtors. "It's an advertising vehicle, just as Realtor.com is; people can go there and access properties up on the MLS, just as they can on Realtor.com. But it is only some listings and some agents, not a complete list." Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

California State's Air Is Among Nation's Most Toxic. "Only New York has a higher risk of cancer caused by airborne chemicals, the EPA says. In the Los Angeles area, the cancer threat is much higher, 93 per million in Los Angeles County — or one person in every 10,700 — and 79 per million in Orange County. The national average is 41.5 per million: one in every 24,000 Americans. Riverside and San Bernardino counties are near the U.S. average." Well, what can I say? The air is just better over here in the Inland Empire! Click here to read more.

More Than 117,000 New Pre-Foreclosures and Foreclosures Reported. Georgia, Michigan, Indiana Post Highest Foreclosure Rates. February 2006 Monthly U.S. Foreclosure Market Report, which shows 117,259 properties nationwide entered some stage of foreclosure in February, a 13 percent increase from the previous month and a

More Than 117,000 New Pre-Foreclosures and Foreclosures Reported. Georgia, Michigan, Indiana Post Highest Foreclosure Rates. February 2006 Monthly U.S. Foreclosure Market Report, which shows 117,259 properties nationwide entered some stage of foreclosure in February, a 13 percent increase from the previous month and a68 percent increase from February 2005. The report shows a February national

foreclosure rate of one new foreclosure for every 986 U.S. households. "This is the third straight month the U.S. foreclosure rate has moved higher, and it's the second straight month new foreclosures have topped 100,000," said James J. Saccacio, chief executive officer of RealtyTrac. "However, several states, including California, Florida, Texas and New York, reported a dip in foreclosures in February. We'll see if the rest of the country follows that trend in March." Click here to read more.

Barriers to Realty. As licensed real estate agents continue to flood into California's shaky housing market, industry experts and Realtors have questioned how standards can be maintained within the realty profession. A new bill, sponsored by the California Association of Realtors, aims to address some of the industry's concerns by forcing potential professionals to complete their required education before getting their license to buy and sell real estate -- instead of being issued a license before they've finished their classes, as is the current practice. Click here to read more.

Silicon Valley's Tech Revival Spurs Fever for Cashing in Options. For the first time in years, many Silicon Valley technology executives are seeing their stock options move into profitable territory, and they are cashing in at levels not seen since the end of the tech-stock boom in 2000. That's helping restore, for a while at least, a once-major source of wealth for the local economy and California's coffers. In just the past two years, Yahoo Inc. CEO Terry Semel has cashed in about $400 million in stock options. Incomes overall are up in the area. Multimillion-dollar homes are changing hands at a faster clip, real-estate agents say. And people are pouring more money into home remodeling. Click here to read more.

Gains in school rankings an 'A' for sales. HOMES: For both real-estate agents and developers, API results are often a selling point. The winners and losers of the Academic Performance Index released Tuesday include not only students, teachers and principals, but home builders, real-estate agents and private home sellers looking for buyers willing to pay a premium to live near a superior school. "I think you will find the test scores from high schools down to the elementary level are the most significant driver of real-estate values," said Steve Johnson, a director of Metro Study, a Riverside-based real-estate consulting firm. "I always thought if Californians ever figured out how significant a role schools play in the value of their real estate, they would get more involved in and supportive of schools, whether they have children in the local schools or not," he added. The Academic Performance Index, which rank schools statewide and among others with similar characteristics, can also influence home builders choosing locations for new subdivisions. "Before we buy land, we spend time looking at API scores," said Scott Laurie, president of KB Home Inland division. "We even have strategic maps where we have laid out the API scores by school district and down to each specific school." School administrators say they are aware of the impact of students' test scores on real-estate values. Click here to read more.

Google Base -- the next MLS? Real estate listings now searchable via Google. Google Base, a Web site where property listings and other information can be uploaded and displayed online for free, can now be searched via Google, giving rise to visions of the service as a possible "new MLS." It has always been possible to search Google Base itself, but consumers can now input phrases such as "Miami real estate" into Google's main search box and the results will show listings from Google Base. While countless Web sites now exist enabling consumers to search MLS property listings online, those sites often extract personal information from the searchers to be used as leads. Google Base, which launched in November, does not require such information. The product works somewhat similarly to craigslist, making it possible to quickly and easily create a free posting that will appear online and can be located by searching specific terms, such as "real estate for sale." Now, it's possible to find Google Base listings via Google itself. "This looks like Realtor.com Lite," opined Vince Malta, president of the California Association of Realtors. "It's an advertising vehicle, just as Realtor.com is; people can go there and access properties up on the MLS, just as they can on Realtor.com. But it is only some listings and some agents, not a complete list." Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Sunday, March 19, 2006

Sunday, March 19th, 2006: Real Estate News Blog

I have been feeling under the weather these past few days. I haven't been able to blog or write... much less sit up and read about anything. But I'm feeling much better tonight. Thank you everyone, for your concern! If you called me this weekend, I will be checking my voice messages and getting back to everyone on Monday.

As you all know by now, Sunday is my favorite day to consolidate the news articles that I read to share with everyone.

Married or single, you've got to pay the tax. Adding your name to the residence title owned by your fiance, or vice versa, won't change anything. To increase the tax exemption from $250,000 for a single owner to $500,000 for a married couple filing a joint tax return, both spouses must occupy the home at least 24 of the 60 months before its sale. You can each sell your principal residences in the same tax year and claim up to $250,000 tax-free home sale profit on each sale, thanks to Internal Revenue Code 121. That's presuming you each owned and occupied your home at least 24 of the 60 months before its sale. But you will owe capital gains tax, currently at the 15 percent maximum federal tax rate on the capital gain exceeding $250,000. Click here to read more.

Ten Signs Of A Real Estate Apocalypse. If California slid into the sea, would it take the U.S. housing market with it? After a few years of real estate boom, which spread dramatically higher prices to many (though not all) parts of the U.S., the market has recently seemed to change course. On Thursday, the U.S. Census Bureau reported that housing starts were down 7.9% from January to February and had declined 4.8% from February 2005, indicating less demand for new construction. That came three days after the National Association of Realtors predicted that this year would bring "a more level playing field for buyers and sellers on the heels of a five-year sellers market." This won't be a crash, but a soft landing for the real estate market, it appears. But that made us wonder: What would it take to make things really go off the rails? Click here to read more.

Housing Speculators Relocate to Hotter Spots. Some who scored with L.A.-area property take their profits to Las Vegas and Arizona. Their flight may soften the local market's landing. Southern California's high housing prices have at least one silver lining. They have kept speculators like Jay McKee from driving prices even higher — and from making them more likely to tumble. The former technology worker from Manhattan Beach was among thousands who caught the real estate investment bug during the housing boom. He bought an ocean-view condominium in neighboring Hermosa Beach two years ago, spent $30,000 to spruce it up and swiftly resold it for a $250,000 profit. Click here to read more.

Los Angeles County sales totals for February. The chart lists median prices in thousands of dollars for sales of existing single-family homes and condominiums by ZIP Code. Community names are included for convenience. Some ZIP Codes include multiple cities that, due to space limitations, cannot all be listed. Percentage changes are a year-over-year comparison for the reporting month. The price per square foot in the far right column includes only single-family home sales and does not include attached garages. Click here to read more.

Southland Home Prices Hit Record High. Southern California's median home price reached a new record last month, but sales continued to slow as the region's housing market continued its shift from red hot to lukewarm, data released today showed. The median price of all new and existing homes sold in the six-county region in February was $480,000, up from $469,000 in January and about 13% higher than a year ago, research firm DataQuick Information Systems reported. Last month's results eclipsed the previous high of $479,000 reached last December and November. On a county by county basis, San Bernardino County posted the largest price gain, with the February median sales price jumping 27.7% from the same month last year to $373,000. Ventura County followed with an 18.6% increase to $618,000; Los Angeles County posted an increase of 15.6% to $490,000; the median in Orange County increased 11.2% to $617,000; Riverside County experienced a gain of 10.2% to $410,000; and the San Diego County median grew 6.4% to $502,000. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

As you all know by now, Sunday is my favorite day to consolidate the news articles that I read to share with everyone.

Married or single, you've got to pay the tax. Adding your name to the residence title owned by your fiance, or vice versa, won't change anything. To increase the tax exemption from $250,000 for a single owner to $500,000 for a married couple filing a joint tax return, both spouses must occupy the home at least 24 of the 60 months before its sale. You can each sell your principal residences in the same tax year and claim up to $250,000 tax-free home sale profit on each sale, thanks to Internal Revenue Code 121. That's presuming you each owned and occupied your home at least 24 of the 60 months before its sale. But you will owe capital gains tax, currently at the 15 percent maximum federal tax rate on the capital gain exceeding $250,000. Click here to read more.

Ten Signs Of A Real Estate Apocalypse. If California slid into the sea, would it take the U.S. housing market with it? After a few years of real estate boom, which spread dramatically higher prices to many (though not all) parts of the U.S., the market has recently seemed to change course. On Thursday, the U.S. Census Bureau reported that housing starts were down 7.9% from January to February and had declined 4.8% from February 2005, indicating less demand for new construction. That came three days after the National Association of Realtors predicted that this year would bring "a more level playing field for buyers and sellers on the heels of a five-year sellers market." This won't be a crash, but a soft landing for the real estate market, it appears. But that made us wonder: What would it take to make things really go off the rails? Click here to read more.

Housing Speculators Relocate to Hotter Spots. Some who scored with L.A.-area property take their profits to Las Vegas and Arizona. Their flight may soften the local market's landing. Southern California's high housing prices have at least one silver lining. They have kept speculators like Jay McKee from driving prices even higher — and from making them more likely to tumble. The former technology worker from Manhattan Beach was among thousands who caught the real estate investment bug during the housing boom. He bought an ocean-view condominium in neighboring Hermosa Beach two years ago, spent $30,000 to spruce it up and swiftly resold it for a $250,000 profit. Click here to read more.

Los Angeles County sales totals for February. The chart lists median prices in thousands of dollars for sales of existing single-family homes and condominiums by ZIP Code. Community names are included for convenience. Some ZIP Codes include multiple cities that, due to space limitations, cannot all be listed. Percentage changes are a year-over-year comparison for the reporting month. The price per square foot in the far right column includes only single-family home sales and does not include attached garages. Click here to read more.

Southland Home Prices Hit Record High. Southern California's median home price reached a new record last month, but sales continued to slow as the region's housing market continued its shift from red hot to lukewarm, data released today showed. The median price of all new and existing homes sold in the six-county region in February was $480,000, up from $469,000 in January and about 13% higher than a year ago, research firm DataQuick Information Systems reported. Last month's results eclipsed the previous high of $479,000 reached last December and November. On a county by county basis, San Bernardino County posted the largest price gain, with the February median sales price jumping 27.7% from the same month last year to $373,000. Ventura County followed with an 18.6% increase to $618,000; Los Angeles County posted an increase of 15.6% to $490,000; the median in Orange County increased 11.2% to $617,000; Riverside County experienced a gain of 10.2% to $410,000; and the San Diego County median grew 6.4% to $502,000. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, March 16, 2006

Thursday, March 16th, 2006: Real Estate News

Real estate mogul turns to mortgage. Trump launches mortgage brokerage company. If Donald Trump launched a mortgage venture, you would expect it to be named Trump Mortgage. He did…and it is. Trump Mortgage LLC, based in the Trump Building at 40 Wall St. in New York, offers residential mortgages, commercial mortgages and home equity loans. The company also targets luxury mortgages for high-end residential and commercial real estate. According to its Web site, at TrumpMortgage.com, the company is a registered mortgage broker in New York, California, Florida, New Hampshire and Connecticut, and is also licensed in Alaska and Colorado. There are registrations pending in Delaware, Massachusetts and New Jersey, with "future registration as mortgage broker in all other states in process." Trump Mortgage arranges mortgage loans with third-party providers. Click here to read more.

Director: Home prices to go up. Prices will continue to increase for homes in California even as the housing market slows down a little, said the executive director of a real estate research group based at Cal Poly Pomona on Wednesday. Home sales started to slow in the fourth quarter but the home market should continue to be strong for the rest of the year, said Michael Carney, executive director for the Real Estate Research Council of Southern California. "I think prices are going to keep rising through 2006," Carney said. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Director: Home prices to go up. Prices will continue to increase for homes in California even as the housing market slows down a little, said the executive director of a real estate research group based at Cal Poly Pomona on Wednesday. Home sales started to slow in the fourth quarter but the home market should continue to be strong for the rest of the year, said Michael Carney, executive director for the Real Estate Research Council of Southern California. "I think prices are going to keep rising through 2006," Carney said. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, March 15, 2006

Wednesday, March 15th, 2006: Real Estate News and More!

Reports on Fed banks' economic conditions. SAN FRANCISCO: Retail sales grew and tourism activity was vigorous. Manufacturers reported generally solid demand. Residential real-estate activity generally remained at high levels but slowed in some areas. Signs of significant cooling were reported in some previously hot markets in Hawaii, Arizona and California. Commercial real-estate activity improved. Click here to read more.

The frenzy is behind us. The median price of an Orange County home rebounded to $617,000 in February, but sales continued to be sluggish, DataQuick reported Tuesday. Five of the six Southern California counties tracked by DataQuick saw home sales drop from year-ago levels. Riverside, where sales increased 4.8 percent, was the exception. Regionwide, prices were up an average of 12.9 percent from a year ago. Prices were up 27.7 percent in San Bernardino County, 18.6 percent in Ventura County, 15.6 percent in Los Angeles County and 10.2 percent in Riverside County, the real estate market tracker reported. In San Diego County, considered to be the leading edge of the Southern California market, the median home price was up 6.4 percent from a year earlier. Click here to read more.

The frenzy is behind us. The median price of an Orange County home rebounded to $617,000 in February, but sales continued to be sluggish, DataQuick reported Tuesday. Five of the six Southern California counties tracked by DataQuick saw home sales drop from year-ago levels. Riverside, where sales increased 4.8 percent, was the exception. Regionwide, prices were up an average of 12.9 percent from a year ago. Prices were up 27.7 percent in San Bernardino County, 18.6 percent in Ventura County, 15.6 percent in Los Angeles County and 10.2 percent in Riverside County, the real estate market tracker reported. In San Diego County, considered to be the leading edge of the Southern California market, the median home price was up 6.4 percent from a year earlier. Click here to read more.

Region's homes staying on the market longer. The number of new and existing homes sold in San Bernardino County decreased 5.4 percent last month, according to DataQuick Information Systems. But prices skyrocketed 27.7 percent from a year earlier as the median climbed to a record $373,000. San Bernardino County was the only housing market in Southern California to see its housing prices pulled into record territory last month, said John Karevoll, a DataQuick analyst. The number of housing units sold throughout Southern California was down 7 percent from February 2005, Karevoll said. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

The frenzy is behind us. The median price of an Orange County home rebounded to $617,000 in February, but sales continued to be sluggish, DataQuick reported Tuesday. Five of the six Southern California counties tracked by DataQuick saw home sales drop from year-ago levels. Riverside, where sales increased 4.8 percent, was the exception. Regionwide, prices were up an average of 12.9 percent from a year ago. Prices were up 27.7 percent in San Bernardino County, 18.6 percent in Ventura County, 15.6 percent in Los Angeles County and 10.2 percent in Riverside County, the real estate market tracker reported. In San Diego County, considered to be the leading edge of the Southern California market, the median home price was up 6.4 percent from a year earlier. Click here to read more.

The frenzy is behind us. The median price of an Orange County home rebounded to $617,000 in February, but sales continued to be sluggish, DataQuick reported Tuesday. Five of the six Southern California counties tracked by DataQuick saw home sales drop from year-ago levels. Riverside, where sales increased 4.8 percent, was the exception. Regionwide, prices were up an average of 12.9 percent from a year ago. Prices were up 27.7 percent in San Bernardino County, 18.6 percent in Ventura County, 15.6 percent in Los Angeles County and 10.2 percent in Riverside County, the real estate market tracker reported. In San Diego County, considered to be the leading edge of the Southern California market, the median home price was up 6.4 percent from a year earlier. Click here to read more.Region's homes staying on the market longer. The number of new and existing homes sold in San Bernardino County decreased 5.4 percent last month, according to DataQuick Information Systems. But prices skyrocketed 27.7 percent from a year earlier as the median climbed to a record $373,000. San Bernardino County was the only housing market in Southern California to see its housing prices pulled into record territory last month, said John Karevoll, a DataQuick analyst. The number of housing units sold throughout Southern California was down 7 percent from February 2005, Karevoll said. Click here to read more.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Tuesday, March 14, 2006

Real Estate News for Tuesday, March 14th, 2006

Next-generation real estate innovators eye transparency. Part 1: New wave of Web innovators lands in real estate. A new wave of online real estate innovators is gathering force, offering consumers more interactive and comprehensive online home searches and more transparency in property data and transactions. In this three-part report, we explore how newcomers like Zillow, Trulia, HomeThinking, PropertyShark, Redfin and others are bringing a new focus to the online consumer. Click here to read more.

Real estate foreclosures on the rise. Western states post 'rapid increase'. The number of new foreclosed residential properties available for sale nationwide increased 9 percent from February 2005 to February 2006, according to data released today by Foreclosure.com, while the total number of foreclosed properties available for sale dropped 7 percent from January 2006 to February 2006. February marks the second consecutive month of declining new foreclosures in the United States, Foreclosure.com reported. About 88,093 foreclosed residential properties were available for sale in the United States in February. There were 21,402 new foreclosures listed for sale in February, a 10.8 percent drop from the prior month. Click here to read more.

Southland Home Prices Hit Record High. Southern California's median home price reached a new record last month, but sales continued to slow as the region's housing market continued its shift from red hot to lukewarm, data released today showed. The median price of all new and existing homes sold in the six-county region in February was $480,000, up from $469,000 in January and about 13% higher than a year ago, research firm DataQuick Information Systems reported. Last month's results eclipsed the previous high of $479,000 reached last December and November. While last month's year-over-year price increase is high by historical standards, it is relatively modest in light of the huge gains the region has seen in recent years and the lowest annual increase since March 2002 when prices rose 12.7%, according to DataQuick. The number of homes sold last month was the lowest in five years, DataQuick said. A total of 19,905 homes changed hands, 7.0% fewer than a year ago, and 0.9% fewer than in January. Click here to read more.

Builders strike a delicate balance. Materials prices have soared due to overseas demand, but the extra cost has been absorbed by the still-strong O.C. real estate market. While the mantra of the real estate market is location, location, location, the chant in the building-materials market might well be globalization, globalization, globalization. In a clear example of how global markets are affecting local lives, mammoth overseas projects like China's Yangtze River Dam are driving up the cost of the Santa Ana (I-5) Freeway widening and other construction in Orange County, people in the industry say. Click here to read more.