Real estate expected to flounder in 2007. Although few experts predict that home values will fall dramatically in 2007, many economists say that prices won't improve for 12 to 18 months. And without the cushion of rising home equity -- which softened the blow of high oil prices last year and kept consumers buying big-ticket items at a rapid clip -- Americans may lose confidence in their finances, and the broader economy is likely to suffer. "We are currently experiencing the worst of the market freeze, which is being exacerbated by the gap between the buyer's desire for bargains and the seller's fantasy of what they once thought their homes would be worth," said Diane Swonk, chief economist for Chicago-based Mesirow Financial, who forecasts a rebound in early 2008. "The good news is that there are some signs of stabilization. The bad news is that a substantial backlog of unsold homes still exists." The number of Californians who could comfortably pay the mortgage on an entry-level home fell to 24 percent in the third quarter -- down from 44 percent in 2003, according to the California Association of Realtors. Source.

Foreclosures Increase 4 Percent in November According to RealtyTrac(TM) U.S. Foreclosure Market Report. November's Foreclosure Rate Highest of the Year

Activity Up 68 Percent From November 2005. RealtyTrac®, the leading online marketplace for foreclosure properties, today released its November 2006 U.S. Foreclosure Market Report, which shows that 120,334 properties nationwide entered some stage of foreclosure during the month, an increase of 4 percent from the previous month and an increase of 68 percent from November 2005. The report also shows a national foreclosure rate of one new foreclosure filing for every 961 U.S. households, the highest monthly foreclosure rate reported so far this year. Source.

Most Expensive Home Sales 2006. For the fourth consecutive year, Forbes.com has compiled a list of the year’s residential real estate deals. In the face of a general housing market slowdown, 2006 was a banner year for those that deal in high-end homes. The average price of a home on our list was $40 million, up more than 10% from 2005’s $36 million average, and more than 55% from the 2003 average. Source.

How Bad Will the 2007 Property Market Be? Economists predict that next year will be tough, but some metros will hold up nicely and the future may not be as gloomy as some fear. Interest rates will remain at historically low levels, homebuyers will see more opportunities, and, best of all, for those planning for the long term, 2009 could be primed for a comeback. Home prices will continue to fall in some markets, and the rate of price appreciation will slow in most places. Declines in homes sales, which directly influence price trends, will set the stage for another year of price decreases in 2008. Foreclosures will continue to increase. For those struggling to hold onto their homes, their net worth will shrink as these homes lose value. Long-term mortgage rates will rise. Housing starts will see double-digit depreciation, the sharpest decline since 1991, the worst year for housing starts on record. Grim as that might sound, there are some bright spots. Nationwide, home prices will be flat to up slightly in 2007, with many large markets seeing small increases. While new home sales will be down for the year, existing home sales will also be flat. And housing starts won't see as sharp a decline as they did in the early '90s or early '80s. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Southern California Inland Empire real estate market trends and updates.

Realtor Tina Jan helps Southern California home buyers and sellers. Her market area is Beaumont, Banning, Cherry Valley, Yucaipa, Calimesa, San Jacinto, Hemet, Redlands, Loma Linda, Riverside, Moreno Valley, Fontana, Highland, Rancho Cucamonga, Upland, and other local Inland Empire cities.

Tuesday, December 12, 2006

Saturday, December 09, 2006

Real Estate News for Saturday, December 9th, 2006

How Low Will Real Estate Go? No one's arguing that the boom is over. But just how far prices may drop is much less certain. Here's what some economists expect nationally, along with predictions for 15 metro areas. Many property owners are reluctant to cut their prices. Unlike builders, who are so desperate to sell their properties that some are throwing in extras like upgraded countertops and one-week vacations, many sellers are willing to wait. Their logic is simple, Leamer explained, "A lot of owners figure, 'My idiot neighbor sold his home for $1 million, and I'm not taking a penny less.'"On the other side of the equation are the buyers, equally strong-willed. Unwilling to fork over those sums in a wavering market, they are watching from the sidelines, waiting for prices to drop. What's more, two key sources of housing demand are locked out of the market, explained Moody's Zandi. One is first-time home buyers, who can't afford to buy given the mix of rising interest rates and still-high home prices. The other is speculators, who can no longer benefit from dramatic appreciation by flipping real estate. Source.

3 Simple Steps to Reel In Buyers. Think like a potential buyer and your mission becomes clear, an expert renovator says. That means fixing what can be seen (or smelled) first. The single most cost-effective investment you can make to increase the value of your home is to buy a roll or two of plastic trash bags. Stuff them with junk outside the house -- from beer cans to raked leaves. Nothing could be more common-sense than cleaning up the yard and exterior, right? "You'd be surprised at how many people don't recognize the importance of doing these kinds of items," says Steve Berges, a real estate investor in Michigan who buys dilapidated houses, fixes them up and sells them for a profit. His advice: When renovating a house or preparing it for sale, spend money on things a buyer can see. Source.

What to do if your home isn't selling. From rethinking your color scheme to holding open houses on weeknights, here are 10 tips for sparking interest in your home. Take a second look at your listing price. Visit open houses in your neighborhood. Are similar homes priced lower? Selling prices may have dropped since your first comparative market analysis. In a hot market, if you haven't sold your home within one month, chances are good that you've overpriced it. If you do lower your asking price, consider a figure slightly below those of other comparable homes if you are interested in a speedy sale. Want to see the other 10 tips? Click the Source link. Source.

Forecast: '07 state economy to slow. The health of the California economy in 2007 will depend on whether the current weakness in the real estate market saps the strength of the state's retail sales, tax base or the job market, according to a report released today by the UCLA Anderson Forecast. The economists at the forecast – one of the state's best-known economic panels – conclude that both the state and national economy will likely be sluggish through next year before improving slightly in 2008. Source.

How To Sell Your Home In 2007. If you're trying to sell your home in 2007, brokers have one piece of advice: Make sure the price is right. Perhaps your neighbor made a bundle by putting his home on the market just when prices peaked. Maybe your sister sold her condo last month, reaping a 40% return. But when it comes to your own abode, that means nothing. Sellers need to get real, and sometimes that means dropping the price. Unfortunately, many sellers are suffering from housing bust denial. "All sellers are human," says Sharon E. Baum, a senior vice president with Corcoran Real Estate in New York City. "Hope springs eternal, right?" Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

3 Simple Steps to Reel In Buyers. Think like a potential buyer and your mission becomes clear, an expert renovator says. That means fixing what can be seen (or smelled) first. The single most cost-effective investment you can make to increase the value of your home is to buy a roll or two of plastic trash bags. Stuff them with junk outside the house -- from beer cans to raked leaves. Nothing could be more common-sense than cleaning up the yard and exterior, right? "You'd be surprised at how many people don't recognize the importance of doing these kinds of items," says Steve Berges, a real estate investor in Michigan who buys dilapidated houses, fixes them up and sells them for a profit. His advice: When renovating a house or preparing it for sale, spend money on things a buyer can see. Source.

What to do if your home isn't selling. From rethinking your color scheme to holding open houses on weeknights, here are 10 tips for sparking interest in your home. Take a second look at your listing price. Visit open houses in your neighborhood. Are similar homes priced lower? Selling prices may have dropped since your first comparative market analysis. In a hot market, if you haven't sold your home within one month, chances are good that you've overpriced it. If you do lower your asking price, consider a figure slightly below those of other comparable homes if you are interested in a speedy sale. Want to see the other 10 tips? Click the Source link. Source.

Forecast: '07 state economy to slow. The health of the California economy in 2007 will depend on whether the current weakness in the real estate market saps the strength of the state's retail sales, tax base or the job market, according to a report released today by the UCLA Anderson Forecast. The economists at the forecast – one of the state's best-known economic panels – conclude that both the state and national economy will likely be sluggish through next year before improving slightly in 2008. Source.

How To Sell Your Home In 2007. If you're trying to sell your home in 2007, brokers have one piece of advice: Make sure the price is right. Perhaps your neighbor made a bundle by putting his home on the market just when prices peaked. Maybe your sister sold her condo last month, reaping a 40% return. But when it comes to your own abode, that means nothing. Sellers need to get real, and sometimes that means dropping the price. Unfortunately, many sellers are suffering from housing bust denial. "All sellers are human," says Sharon E. Baum, a senior vice president with Corcoran Real Estate in New York City. "Hope springs eternal, right?" Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, November 29, 2006

Real Estate News for Wednesday, November 29th, 2006

Sales of homes cool in October. Experts say local housing market hasn't bottomed out yet. California's residential real estate market cooled dramatically in October with prices falling below the year-ago level in a majority of major markets and sales posting the weakest total for the month in 18 years. Last month, statewide sales of previously owned homes fell 28.7 percent and the median price rose 2 percent. But it declined in 14 of the 20 major markets tracked by the Los Angeles-based group. And in seven markets, including Orange and San Diego counties, the median price has fallen below its year-ago point for three consecutive months. If sales proceeded at October's pace all year, 443,320 properties would change hands. That's the smallest annualized rate for the month since 478,770 projected sales in October 1988. Sales have now been at their current level for three months. "The market is still in a decline. Most people don't look for it to really bottom out until late 2007," said Jack Kyser, chief economist at the the Los Angeles County Economic Development Corp. Source.

Agassi, Graf sell their Tiburon estate for $20 million. Retired tennis stars Andre Agassi and wife, Steffi Graf, have agreed to unload their 13,000-square-foot Tiburon estate for $20 million - $3 million less than they paid for it five years ago. The residential sale amount is the second-highest in Marin history. The first was when Agassi purchased it in 2001 for $23 million. Agassi's original asking price was $24.5 million. The couple - who live primarily in Las Vegas - are selling their home to Marin resident Stuart Peterson, the head of Arts Capital Management, a California hedge fund that invested in the Web video site YouTube before it was purchased this year by Google. Source.

Going it alone. More single women buying their own home. Percentage of female home buyers reaches record high of 22 percent. From July 2005 to June 2006, unattached women made up 22 percent of all home buyers--a record high. During the same time period in 1995, 14 percent of home purchases were made by single women. Cultural and societal progress have contributed to the growth of female investment. In the 1970s "women had a hard time getting a credit card much less a mortgage," said NAR spokesman Walter Molony. "They were not being taken seriously by the lending community." But higher education and workplace advancements among women have led more of them to enter the real-estate market. "The biggest change in household composition over time has been in women buyers," Molony said. The percentage of female homeowners reached double digits during the 1990s when the Federal Housing Administration allowed women to count child support as income. "It made a real difference for single mothers," Molony said. "That accounted, presumably, for the increases we saw in the 1990s." Financial education has also given women the confidence to purchase a home on their own. According to the NAR report, women are also buying property at a faster rate than single men, who made up 9 percent of all home sales. This could be because "women kind of have a nesting instinct and understand the value of housing as an investment," Molony suggested. "Men, when they're young and single, aren't." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Agassi, Graf sell their Tiburon estate for $20 million. Retired tennis stars Andre Agassi and wife, Steffi Graf, have agreed to unload their 13,000-square-foot Tiburon estate for $20 million - $3 million less than they paid for it five years ago. The residential sale amount is the second-highest in Marin history. The first was when Agassi purchased it in 2001 for $23 million. Agassi's original asking price was $24.5 million. The couple - who live primarily in Las Vegas - are selling their home to Marin resident Stuart Peterson, the head of Arts Capital Management, a California hedge fund that invested in the Web video site YouTube before it was purchased this year by Google. Source.

Going it alone. More single women buying their own home. Percentage of female home buyers reaches record high of 22 percent. From July 2005 to June 2006, unattached women made up 22 percent of all home buyers--a record high. During the same time period in 1995, 14 percent of home purchases were made by single women. Cultural and societal progress have contributed to the growth of female investment. In the 1970s "women had a hard time getting a credit card much less a mortgage," said NAR spokesman Walter Molony. "They were not being taken seriously by the lending community." But higher education and workplace advancements among women have led more of them to enter the real-estate market. "The biggest change in household composition over time has been in women buyers," Molony said. The percentage of female homeowners reached double digits during the 1990s when the Federal Housing Administration allowed women to count child support as income. "It made a real difference for single mothers," Molony said. "That accounted, presumably, for the increases we saw in the 1990s." Financial education has also given women the confidence to purchase a home on their own. According to the NAR report, women are also buying property at a faster rate than single men, who made up 9 percent of all home sales. This could be because "women kind of have a nesting instinct and understand the value of housing as an investment," Molony suggested. "Men, when they're young and single, aren't." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, November 16, 2006

Real Estate News for Thursday, November 16th, 2006

Housing market drag on state until 2008? The downturn in the housing industry will continue to depress the state's economy for most of next year before stabilizing in 2008, the Legislature's top budget analyst predicted Wednesday. Legislative Budget Analyst Elizabeth Hill forecast that residential construction will fall by 4.4 percent in 2006 and by an additional 13 percent in 2007. Then the analyst said it should stabilize with about 175,000 permits issued annually through 2012. The real estate industry, which includes developers, contractors, real estate brokers, title companies and financial institutions, make up 15 percent to 20 percent of the state's private sector economy. The slowdown in this industry was the largest single factor in a sharp decline in personal income growth, resulting in a drop in withholding tax payments from over ten percent in the first half of 2006 to less than five percent in the third quarter. Source.

Study: Home sellers making big money. Experts say profits especially big for those who hold on to houses for years. Nearly half of homeowners in Riverside County who sold their residences last month more than doubled their money, a new study shows. Home sellers across the county came away with a $178,000 "median" profit, meaning half of them earned more and half earned less, according to statistics compiled by economist Christopher Cagan, who heads the real estate research arm for Santa Ana-based title company First American Corp. Median dollar gains from home sales ranged from $178,000 in Riverside County to $331,500 in Orange County, according to Cagan's analysis. The median profit earned in San Bernardino County was $203,500, while homeowners saw profits of $331,500 in Orange County and $266,000 in Los Angeles County. In San Diego County, where the median profit was $243,000, home sellers earned about 91 percent profit. In the Coachella Valley and elsewhere across Southern California, those who've remained in their homes three or more years appear to have reaped some of the biggest financial rewards. It also allowed them to avoid a tax hit on significant equity gains they may have netted, real estate agents said. Median profit figures are based on sales of existing homes occurring from Sept. 27 through Oct. 26 in the five counties. Cagan's analysis didn't take into account homeowner expenses for everything from landscaping upgrades to repairs or agent commissions. Source.

OC Market Plays Waiting Game. "The waiting game" was a common theme reverberating throughout yesterday's third annual RealShare Orange County conference, held at the Hyatt Regency Irvine. With roughly five million sf of office product set to hit the market over the next 24 months, developers and tenants alike are waiting to see who will blink first. And with good reason--Orange County's been here before. The early 90s saw many deep pockets emptied as supply outpaced demand. A shared mindset said "never again." John Parker, chairman of Parker Properties, said it can be difficult to avoid a dip once the machinery gets going. "After the last cycle, lenders said they would not let this happen again, but they're pushing money at us," he noted. Insiders debated whether history is set to repeat itself, asking if the market is gearing for a precipitous fall. The general consensus favored cautious optimism, echoing the familiar refrain "no, but… ." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Study: Home sellers making big money. Experts say profits especially big for those who hold on to houses for years. Nearly half of homeowners in Riverside County who sold their residences last month more than doubled their money, a new study shows. Home sellers across the county came away with a $178,000 "median" profit, meaning half of them earned more and half earned less, according to statistics compiled by economist Christopher Cagan, who heads the real estate research arm for Santa Ana-based title company First American Corp. Median dollar gains from home sales ranged from $178,000 in Riverside County to $331,500 in Orange County, according to Cagan's analysis. The median profit earned in San Bernardino County was $203,500, while homeowners saw profits of $331,500 in Orange County and $266,000 in Los Angeles County. In San Diego County, where the median profit was $243,000, home sellers earned about 91 percent profit. In the Coachella Valley and elsewhere across Southern California, those who've remained in their homes three or more years appear to have reaped some of the biggest financial rewards. It also allowed them to avoid a tax hit on significant equity gains they may have netted, real estate agents said. Median profit figures are based on sales of existing homes occurring from Sept. 27 through Oct. 26 in the five counties. Cagan's analysis didn't take into account homeowner expenses for everything from landscaping upgrades to repairs or agent commissions. Source.

OC Market Plays Waiting Game. "The waiting game" was a common theme reverberating throughout yesterday's third annual RealShare Orange County conference, held at the Hyatt Regency Irvine. With roughly five million sf of office product set to hit the market over the next 24 months, developers and tenants alike are waiting to see who will blink first. And with good reason--Orange County's been here before. The early 90s saw many deep pockets emptied as supply outpaced demand. A shared mindset said "never again." John Parker, chairman of Parker Properties, said it can be difficult to avoid a dip once the machinery gets going. "After the last cycle, lenders said they would not let this happen again, but they're pushing money at us," he noted. Insiders debated whether history is set to repeat itself, asking if the market is gearing for a precipitous fall. The general consensus favored cautious optimism, echoing the familiar refrain "no, but… ." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, November 01, 2006

Real Estate News for Wednesday, November 1st, 2006

FTC complaint filed against Zillow. The Federal Trade Commission confirmed Tuesday that a consumer group filed a complaint against a leading Web-based real estate appraiser, saying it was "intentionally misleading consumers and real estate professionals" and could be violating civil rights and consumer protection laws. According to the complaint, the coalition conducted an audit and found that Zillow's estimates fell within 10 percent of the actual appraised value less than one-third of the time. The coalition's complaint states that "deceptive and inaccurate valuations undervalue entire communities." It said that over-valuations were "prevalent in predominantly white areas" while "under-valuations were more frequent" in predominantly African-American and Latino communities. The FTC did not confirm whether it would investigate Zillow.com. Source.

Bankers object to mortgage license plan. A state mortgage brokers association wants uniform standards instead of the current dual qualifying system. The California Mortgage Bankers Association objected to another group's proposal that loan officers working for banks and mortgage companies meet the same license requirements as independent mortgage brokers. Currently, independent mortgage brokers must take college courses, pass a test and undergo a criminal background check to get a license from the state Department of Real Estate. But employees of lenders can work under the auspices of their company's license from the state Department of Corporations. Last week, the California Association of Mortgage Brokers issued a package of consumer-protection measures, including a proposal calling for uniform licensing for all loan officers. Source.

Can the economy survive the housing bust? Real estate downturns have a way of leading to recessions and stock market slumps. So far the damage has been limited, but the numbers keep getting worse, says Fortune's Jon Birger. An important chart is the National Association of Home Builders' Housing Market index - a monthly measure of builder confidence - against the Standard & Poor's 500 stock market index, with a one-year lag. It turns out that the mood of builders is a terrific stock market bellwether: The correlation between current builder confidence and future stock market returns over the past ten years is downright unnerving. Over the past year, the NAHB housing index plummeted 54 percent. Were stocks to follow suit, the S&P - 1400 in late October - would be trading below 700 this time next year. All the economic activity generated by home sales - new mortgages, realtor fees, outlays to painters and handymen, the inevitable shopping trips to Home Depot and Best Buy - played a huge part in digging the economy out of a recession in 2001 and 2002. Given the importance of home sales on the way up, it may be shortsighted to minimize their importance on the way down. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Bankers object to mortgage license plan. A state mortgage brokers association wants uniform standards instead of the current dual qualifying system. The California Mortgage Bankers Association objected to another group's proposal that loan officers working for banks and mortgage companies meet the same license requirements as independent mortgage brokers. Currently, independent mortgage brokers must take college courses, pass a test and undergo a criminal background check to get a license from the state Department of Real Estate. But employees of lenders can work under the auspices of their company's license from the state Department of Corporations. Last week, the California Association of Mortgage Brokers issued a package of consumer-protection measures, including a proposal calling for uniform licensing for all loan officers. Source.

Can the economy survive the housing bust? Real estate downturns have a way of leading to recessions and stock market slumps. So far the damage has been limited, but the numbers keep getting worse, says Fortune's Jon Birger. An important chart is the National Association of Home Builders' Housing Market index - a monthly measure of builder confidence - against the Standard & Poor's 500 stock market index, with a one-year lag. It turns out that the mood of builders is a terrific stock market bellwether: The correlation between current builder confidence and future stock market returns over the past ten years is downright unnerving. Over the past year, the NAHB housing index plummeted 54 percent. Were stocks to follow suit, the S&P - 1400 in late October - would be trading below 700 this time next year. All the economic activity generated by home sales - new mortgages, realtor fees, outlays to painters and handymen, the inevitable shopping trips to Home Depot and Best Buy - played a huge part in digging the economy out of a recession in 2001 and 2002. Given the importance of home sales on the way up, it may be shortsighted to minimize their importance on the way down. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, October 26, 2006

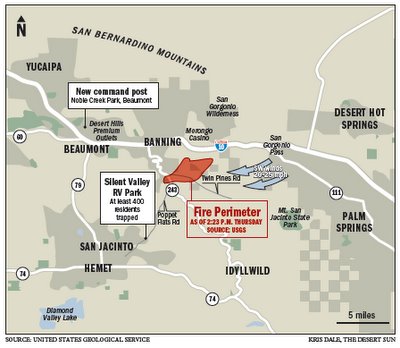

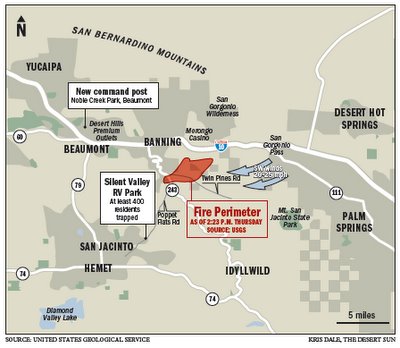

News on the Esperanza Fire

Well if you haven't about today's Esperanza Fire that was started by an arsonist in Cabazon, here are plenty of recent articles about it. My sincerest heart goes out to the friends and families of the fallen firefighters.

Esperanza Fire Evacuation, Donation Information.

Riverside County Red Cross:

American Red Cross Riverside County Processing Center, P.O. Box 55040, Riverside, CA 92517. 1-888-831-0031. http://www.riversidecounty.redcross.org/

Source.

San Diego County sends 200 to fight Esperanza fire. Nearly 200 San Diego County firefighters were sent to help battle the raging Esperanza brush fire in Riverside County Thursday, officials said. Source.

Area Hospitals Brace For Smoke Victims. ER doctors in northern San Diego County are bracing Thursday for an influx of patients suffering from breathing problems as a result of the Esperanza fire. So far, the Esperanza fire near Cabazon has blackened 10,000 acres, driven hundreds of people from their homes, and left hundreds more stranded in an RV park. Three firefighters died at the scene and two were hospitalized in critical condition. One of those two died several hours later. Source.

Pechanga Contributes $50,000 to Support Families of Fallen Firefighters of the Esperanza Fire. The Pechanga Band of Luiseno Indians today announced a contribution of $50,000 to aid the families of the four fighters who lost their lives in the Esperanza wildfire. "We at Pechanga are saddened to hear that four firefighters lost their lives. Our thoughts and prayers are with the families of the firefighters," said Pechanga Tribal Chairman Mark Macarro. "Pechanga's families pray for the safety of the firefighters responding to this wildfire. Pechanga will do what it can to help," said Chairman Macarro. Since this morning, an engine from the Pechanga Fire Department was on the incident as part of a structure protection strike team. Source.

Evacuees recall fleeing fast moving flames near Palm Springs. Source.

Longtime Idyllwild resident always gave to community. That’s how Charlie Clayton described the feeling in Idyllwild over the tragic death of friend and neighbor, U.S. Forest Service fire Capt. Mark Loutzenhiser, in Esperanza fire Thursday. It wasn’t until 6 p.m. Thursday that Clayton learned that flames had overwhelmed his longtime friend and four other Forest Service firefighters near Poppet Flats. Three of those men were killed immediately. Loutzenhiser and the still unidentified fifth firefighter were airlifted to Arrowhead Regional Medical Center in Colton, where he was pronounced dead two hours later. Source.

Eyewitness account from The Desert Sun reporter: 'We were surrounded by fire.' "We counted a half-dozen homes in flames off Gorgonio View Road going into the Twin Pines area. There were some homes that had fire coming up close to the property lines, and other homes engulfed in flames... Power lines were down the road. There were dead rabbits on the road that had been burned. There are these really pretty white plastic picket fences melting on the ground... The fire came down into a lower ridge area. There were trucks there from San Diego, Riverside, Hemet. They were battling flames 50 to 60 feet high..." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Esperanza Fire Evacuation, Donation Information.

Riverside County Red Cross:

American Red Cross Riverside County Processing Center, P.O. Box 55040, Riverside, CA 92517. 1-888-831-0031. http://www.riversidecounty.redcross.org/

Source.

San Diego County sends 200 to fight Esperanza fire. Nearly 200 San Diego County firefighters were sent to help battle the raging Esperanza brush fire in Riverside County Thursday, officials said. Source.

Area Hospitals Brace For Smoke Victims. ER doctors in northern San Diego County are bracing Thursday for an influx of patients suffering from breathing problems as a result of the Esperanza fire. So far, the Esperanza fire near Cabazon has blackened 10,000 acres, driven hundreds of people from their homes, and left hundreds more stranded in an RV park. Three firefighters died at the scene and two were hospitalized in critical condition. One of those two died several hours later. Source.

Pechanga Contributes $50,000 to Support Families of Fallen Firefighters of the Esperanza Fire. The Pechanga Band of Luiseno Indians today announced a contribution of $50,000 to aid the families of the four fighters who lost their lives in the Esperanza wildfire. "We at Pechanga are saddened to hear that four firefighters lost their lives. Our thoughts and prayers are with the families of the firefighters," said Pechanga Tribal Chairman Mark Macarro. "Pechanga's families pray for the safety of the firefighters responding to this wildfire. Pechanga will do what it can to help," said Chairman Macarro. Since this morning, an engine from the Pechanga Fire Department was on the incident as part of a structure protection strike team. Source.

Evacuees recall fleeing fast moving flames near Palm Springs. Source.

Longtime Idyllwild resident always gave to community. That’s how Charlie Clayton described the feeling in Idyllwild over the tragic death of friend and neighbor, U.S. Forest Service fire Capt. Mark Loutzenhiser, in Esperanza fire Thursday. It wasn’t until 6 p.m. Thursday that Clayton learned that flames had overwhelmed his longtime friend and four other Forest Service firefighters near Poppet Flats. Three of those men were killed immediately. Loutzenhiser and the still unidentified fifth firefighter were airlifted to Arrowhead Regional Medical Center in Colton, where he was pronounced dead two hours later. Source.

Eyewitness account from The Desert Sun reporter: 'We were surrounded by fire.' "We counted a half-dozen homes in flames off Gorgonio View Road going into the Twin Pines area. There were some homes that had fire coming up close to the property lines, and other homes engulfed in flames... Power lines were down the road. There were dead rabbits on the road that had been burned. There are these really pretty white plastic picket fences melting on the ground... The fire came down into a lower ridge area. There were trucks there from San Diego, Riverside, Hemet. They were battling flames 50 to 60 feet high..." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, October 25, 2006

Real Estate News for Wednesday, October 25th, 2006

Selling a Slice of Luxury. It is almost too easy to be charmed by the latest trend in time shares, what is called fractional real estate. A high-end spin on the traditional time share, fractionals typically entitle users to multiple weeks’ stay, and the developments themselves have decidedly luxury touches, with upmarket appliances, finishes and linens, as well as amenities like spas. In short, developers say, it is a way to get access to a million dollar-plus property for much less than the full price of ownership. With all the variety on the market today, buying would appear to be a snap. But how these units stand up in the resale market remains to be seen. Source.

Experts call current real estate trends normal. Urge calm as home sales and price appreciation fall. The valley’s recent real estate boom — and the current correction in sales counts and appreciation rates — have not only altered buyers’ and sellers' expectations. They've also got the experts wondering what "normal" should be these days. "It's been so long since we’ve seen a normal market, we've forgotten what it looks like," said Pat Veling, real estate analyst and president of the Brea-based consulting firm Real Data Strategies. Annual home price appreciation is expected to dip to single digits this year, considerably down from as high as 37 percent in 2004. Source.

How to find a real estate bargain. Buyers now have luxury of choice. Everybody wants a bargain. Last year, good real estate deals were few and far between. This was due to the fact that inventories of homes for sale were at record low levels. And, there was an abundance of buyers, all looking for the same thing. Today in most areas, buyers have the luxury of choice. So, there's less of a chance you'll overpay because you have to outbid another buyer. However, even though there is a lot to choose from, this doesn't mean that it will be easier to buy a property at a bargain price. One reason is that most sellers aren't desperate to sell. Just because the market has changed doesn't mean that sellers are slashing their prices dramatically. Many listings that have price reductions were overpriced to begin with.

Another factor is that there is usually little consistency in pricing. Some listings are well-priced, others are overpriced, and then there is the occasional listing that is actually priced below market value. Another complicating factor is variability. Unless you're looking at listings in a single tract development, where each house is a cookie cutter of the others, you'll find disparities in age, condition, size and amenities. Each of these variables has an affect on market value. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Experts call current real estate trends normal. Urge calm as home sales and price appreciation fall. The valley’s recent real estate boom — and the current correction in sales counts and appreciation rates — have not only altered buyers’ and sellers' expectations. They've also got the experts wondering what "normal" should be these days. "It's been so long since we’ve seen a normal market, we've forgotten what it looks like," said Pat Veling, real estate analyst and president of the Brea-based consulting firm Real Data Strategies. Annual home price appreciation is expected to dip to single digits this year, considerably down from as high as 37 percent in 2004. Source.

How to find a real estate bargain. Buyers now have luxury of choice. Everybody wants a bargain. Last year, good real estate deals were few and far between. This was due to the fact that inventories of homes for sale were at record low levels. And, there was an abundance of buyers, all looking for the same thing. Today in most areas, buyers have the luxury of choice. So, there's less of a chance you'll overpay because you have to outbid another buyer. However, even though there is a lot to choose from, this doesn't mean that it will be easier to buy a property at a bargain price. One reason is that most sellers aren't desperate to sell. Just because the market has changed doesn't mean that sellers are slashing their prices dramatically. Many listings that have price reductions were overpriced to begin with.

Another factor is that there is usually little consistency in pricing. Some listings are well-priced, others are overpriced, and then there is the occasional listing that is actually priced below market value. Another complicating factor is variability. Unless you're looking at listings in a single tract development, where each house is a cookie cutter of the others, you'll find disparities in age, condition, size and amenities. Each of these variables has an affect on market value. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Tuesday, October 24, 2006

Real Estate News for Tuesday, October 24th, 2006

If you do anticipate selling in the short term then listen up. The current market situation may not be impacting your situation at all or it may even have some positive ramifications. Re-evaluate your time table. Be realistic about your profit. Price well from the get-go and if you must adjust your price, bite the bullet. Forget lavish inducements. Know your local market. Consult with a knowledgeable real estate agent about current activity and follow their advice about pricing and positioning your property and any hints they have to offer about making the house more attractive. Source.

High-end real estate listings crowd California market. Sales of homes priced above $2.5 million in a seven-county region in Northern California increased from 210 homes in third-quarter 2005 to 214 homes in third-quarter 2006. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

High-end real estate listings crowd California market. Sales of homes priced above $2.5 million in a seven-county region in Northern California increased from 210 homes in third-quarter 2005 to 214 homes in third-quarter 2006. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Coldwell Banker Kivett-Teeters Pays Your December House Payment!

Win Your December House Payment!

Let Coldwell Banker Kivett-Teeters make your Holidays! Win your December house payment! (Up to $4,000.00). Stop by and Register at any of our FIVE offices! If you have any questions, ask me! Come into my office, fill out a registration slip, and tell all your friends!

Coldwell Banker Kivett-Teeters Offices:

Yucaipa: 32839 Yucaipa Blvd. Suite A, Yucaipa, CA 92399

Beaumont: 1655 E. 6th St., Beaumont, CA 92223

Highland: 3505 E. Highland Ave. Suite F, Highland, CA 92346

Hemet: 610 E. Florida, Suite A, Hemet, CA 92343

Rancho Cucamonga: 11398 Kenyon Way, Suite G, Rancho Cucamonga, CA 91701

Drawing to be held on Wednesday, November 22nd, at 1:00pm. Winner is not required to be present. Sponsored by Coldwell Banker Kivett-Teeters Associates. No obligation. Certain restrictions and rules apply.

Contest Rules for: Win Your December 2006 House Payment

One entry per household. Must be at least 21 years old. Maximum reward is actual house payment or $4,000.00, whichever the lesser amount is. Payment must be for the address shown on the entry form. Winner must occupy the property. Payment to be made upon presentation of payment coupon or proof of payment amount. Employees/agents and immediate family members of Coldwell Banker Kivett-Teeters, Valley View Mortgage, K-T Services, and Yucaipa Express Lube and Car Wash are not eligible to participate. All entries must be made in person at any Coldwell Banker Kivett-Teeters office during normal business hours. No obligation to enter. Drawing for the winning ticket will be held at the Yucaipa office at 1:00pm on November 22nd, 2006. Winner need not be present to win.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Let Coldwell Banker Kivett-Teeters make your Holidays! Win your December house payment! (Up to $4,000.00). Stop by and Register at any of our FIVE offices! If you have any questions, ask me! Come into my office, fill out a registration slip, and tell all your friends!

Coldwell Banker Kivett-Teeters Offices:

Yucaipa: 32839 Yucaipa Blvd. Suite A, Yucaipa, CA 92399

Beaumont: 1655 E. 6th St., Beaumont, CA 92223

Highland: 3505 E. Highland Ave. Suite F, Highland, CA 92346

Hemet: 610 E. Florida, Suite A, Hemet, CA 92343

Rancho Cucamonga: 11398 Kenyon Way, Suite G, Rancho Cucamonga, CA 91701

Drawing to be held on Wednesday, November 22nd, at 1:00pm. Winner is not required to be present. Sponsored by Coldwell Banker Kivett-Teeters Associates. No obligation. Certain restrictions and rules apply.

Contest Rules for: Win Your December 2006 House Payment

One entry per household. Must be at least 21 years old. Maximum reward is actual house payment or $4,000.00, whichever the lesser amount is. Payment must be for the address shown on the entry form. Winner must occupy the property. Payment to be made upon presentation of payment coupon or proof of payment amount. Employees/agents and immediate family members of Coldwell Banker Kivett-Teeters, Valley View Mortgage, K-T Services, and Yucaipa Express Lube and Car Wash are not eligible to participate. All entries must be made in person at any Coldwell Banker Kivett-Teeters office during normal business hours. No obligation to enter. Drawing for the winning ticket will be held at the Yucaipa office at 1:00pm on November 22nd, 2006. Winner need not be present to win.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, October 12, 2006

Real Estate News for Thursday, October 12th, 2006

San Diego County sees declines unseen since early '90s. Perhaps the biggest surprise came in the resale-house category, which makes up about half of the home-selling market. The September median stood at $545,000, down $5,000 from a year ago, marking the first year-over-year drop since July 1996. Resale houses had risen to a record median of $569,500 in May before dropping to the present level. "That tends to be the center of gravity for statistics," said DataQuick analyst John Karevoll, explaining that trends for resale condos and new homes typically fall in behind resale houses. David Lereah, chief economist of the National Association of Realtors, issued a statement yesterday declaring that the sales decline in many markets appears to be "bottoming out" as lower prices entice potential buyers. Freddie Mac also reported “early signs” of a turnaround, based on falling energy prices, lower mortgage rates, rebounding mortgage refinancings and rising stock prices that bolster household net worth. "There will undoubtedly be more bumps on the way, though, and the ride could be rocky in some markets," the October economic outlook report said, "but the economic fundamentals should help avert a crash landing." Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Thursday, September 28, 2006

County of Riverside GIS

This website is fantastic, and my new best friend! I just had to share it with the rest of the public! I was having a hard time locating a plot of land, but this site pops it right up. Very very convenient.

http://www3.tlma.co.riverside.ca.us/pa/rclis/index.html

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

http://www3.tlma.co.riverside.ca.us/pa/rclis/index.html

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Wednesday, September 20, 2006

Real Estate News for Wednesday, September 20th, 2006

Real Estate’s Web Wake-up. Real estate shakeout could lead to web-driven industry shakeup—the death threats have already started. The Internet has transformed the music, retail, advertising, and software industries over the last decade, but real estate’s classic broker-buyer-seller triumvirate remains essentially in place. Buyers may look at photos of houses online, but they still normally hire brokers to show them lists of homes, while sellers hire brokers to list their homes on the Multiple Listing Service (MLS) and camp out at open houses on Sundays. Brokers usually charge the seller about 6 percent of the sales price for their services, then split this commission 50-50 with the buyer’s agent that brings the client to the deal. Source.

Home Prices Fall for 2nd Month. The median price of an Orange County home fell for a second straight month in August to $633,000 while the number of houses sold continued its sharp decline from a year ago. Many sellers are opting to pull their homes off the market. In August, there were 3,121 homes pulled off the market by disgruntled sellers, compared to 1,262 a year earlier, according to data from the Aliso Viejo-based office of ReMax Real Estate Services. Source.

Panel to Address Housing Bubble. The discussion, “Bubble, Bubble, Toil and Trouble: Trends in California Real Estate,” will tackle the elusive subject of whether the runup in housing prices over the past few years constitutes a “bubble” and whether the real estate market is in for a hard or a soft landing now that home sales have slowed considerably. Also slated to speak are. Robert Edelstein, real estate development professor at UC Berkeley’s Haas School of Business, and Christopher Thornberg, principal at Beacon Economic. The event, hosted by the Los Angeles Chapter of Berkeley’s Haas School of Business, will take place Sept. 25 at 6:30 p.m. at the Luxe Hotel in L.A. For more information, call (310) 999-3411 or visit acteva.com/go/haasla. Source.

Panic Setting In As Market Continues to Slump: Consumer Advocate Giving Mammoth Boost to Ethical Real Estate Agents & Loan Officers. The latest housing data is shattering confidence in the most seasoned industry professionals. Homebuilder Toll Brothers said the current slump in construction is the worst in 40 years. The National Association of Realtors forecast a drop in home sales of 8% in 2006, with a further decline in 2007. PMI Mortgage Insurance added to the gloom by predicting a 32.8% chance that home prices will fall in the next two years. Source.

Technology provides competitive edge. Part 3: Surviving a real estate downturn. As the housing market slows, budgets tighten, and some buyers and sellers may be clinging to unrealistic interpretations of local market conditions. Real estate agents will find themselves competing harder for clients, especially in a time when consumer Web sites are popping up everyday, giving consumers a sense of empowerment over what they do and do not know. In this four-part series, Inman News examines the effect of the housing slowdown on everyday real estate business. We've asked brokers and agents what they are doing differently with marketing now that listing times are longer, how they are keeping an edge, and how a slowdown may or may not be impacting commission rates. Source.

Zillow: Good Real Estate Idea is a Fixer. A Web site allows buyers and sellers to find value of homes without providing personal info, however data is often inaccurate and incomplete. Zillow isn't the only free, proprietary online real estate site. RealEstateABC.com offers comparable functionality with a few extra features, and similar sites are sure to emerge. Yahoo! Real Estate announced in late July that Zillow would be incorporated into its site as an added functionality tool, and at least one major real estate brokerage, Prudential California/Nevada Realty, announced the incorporation of Zillow within its own website. Source.

To believers, saint moves homes. Real estate cool-down prompts some sellers to buy into burial legend of St. Joseph. Judy Moore knew she was going to have trouble selling the home with the really steep driveway. For help, she turned not to an advertiser or a fellow real estate agent, but to someone she hadn't used since the last slowdown in the housing market: St. Joseph. She buried a figurine of the Roman Catholic saint upside down in the home's yard. And soon, sure enough, she had her sale. Source.

Real Estate Appraising: Chilled, But Not Frozen. It can be tricky to arrive at a valuation in a cooling market. Traditionally, appraisers inspect the property's physical condition, functionality and surrounding neighborhood. Then they compare that property to the comparable recent sales, making adjustments to price estimates for features that are superior or inferior. Some appraisers say the boom provided a temptation to cut corners and complete more appraisals in less time. Now, in cooling markets, the sales prices of the comparable properties may not account for the price drops some neighborhoods have seen. And those selling the homes may be throwing in incentives like cash-back rebates or electronic extras, meaning the effective sale price of the home could be considerably less than the recorded selling price. During the boom, housing was in such demand that buyers would bid each other up, past the seller's asking price. Once a highest bidder was determined, the lender for that bidder's mortgage would send an appraiser to complete a valuation on the property. The appraiser's job in that situation is to make sure the buyer isn't paying dramatically more than the home is worth, so that the lender can avoid lending more money than necessary. Klinge said he thinks the appraisers usually lined their estimates up with where the market was trending -- up. Source.

Home Price Appreciation Slackens. The Southland median rose 2.7% in August, the smallest year-over-year increase since 1999. Even the Inland Empire — one of the nation's fastest-growing economies — is no longer enjoying double-digit gains. The last time each of the six Southland counties posted single-digit increases: December 1999. Southland home prices have been relatively flat on a month-to-month basis since March. The problem: There simply are more homes available for sale than people willing to buy them at current prices. Sales fell 25.3% to 25,628 in August, the ninth consecutive month of declines and the worst August since 1997. After six years of sizzling price appreciation that doubled Southland home values, potential buyers now appear to be collectively sitting on the sidelines. August was the first month since December 2002 that San Bernardino County, considered the most affordable local housing market, rose at a single-digit growth rate. The median price increased 6.1% to $365,000. Neighboring Riverside County's median rose 7% to $415,000. Sales in the Inland Empire fell more than 20%. Orange County remained the most expensive local region, with a median price of $633,000, a 2.6% gain from the year before. Ventura County's median rose 1% to $598,000. Sales fell 32% in Orange County and dropped 31.8% in Ventura County. Los Angeles County's median, as reported last week, rose 4.7% to $517,000. Source.

Southland home prices have been relatively flat on a month-to-month basis since March. The problem: There simply are more homes available for sale than people willing to buy them at current prices. Sales fell 25.3% to 25,628 in August, the ninth consecutive month of declines and the worst August since 1997. After six years of sizzling price appreciation that doubled Southland home values, potential buyers now appear to be collectively sitting on the sidelines. August was the first month since December 2002 that San Bernardino County, considered the most affordable local housing market, rose at a single-digit growth rate. The median price increased 6.1% to $365,000. Neighboring Riverside County's median rose 7% to $415,000. Sales in the Inland Empire fell more than 20%. Orange County remained the most expensive local region, with a median price of $633,000, a 2.6% gain from the year before. Ventura County's median rose 1% to $598,000. Sales fell 32% in Orange County and dropped 31.8% in Ventura County. Los Angeles County's median, as reported last week, rose 4.7% to $517,000. Source.

~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Home Prices Fall for 2nd Month. The median price of an Orange County home fell for a second straight month in August to $633,000 while the number of houses sold continued its sharp decline from a year ago. Many sellers are opting to pull their homes off the market. In August, there were 3,121 homes pulled off the market by disgruntled sellers, compared to 1,262 a year earlier, according to data from the Aliso Viejo-based office of ReMax Real Estate Services. Source.

Panel to Address Housing Bubble. The discussion, “Bubble, Bubble, Toil and Trouble: Trends in California Real Estate,” will tackle the elusive subject of whether the runup in housing prices over the past few years constitutes a “bubble” and whether the real estate market is in for a hard or a soft landing now that home sales have slowed considerably. Also slated to speak are. Robert Edelstein, real estate development professor at UC Berkeley’s Haas School of Business, and Christopher Thornberg, principal at Beacon Economic. The event, hosted by the Los Angeles Chapter of Berkeley’s Haas School of Business, will take place Sept. 25 at 6:30 p.m. at the Luxe Hotel in L.A. For more information, call (310) 999-3411 or visit acteva.com/go/haasla. Source.

Panic Setting In As Market Continues to Slump: Consumer Advocate Giving Mammoth Boost to Ethical Real Estate Agents & Loan Officers. The latest housing data is shattering confidence in the most seasoned industry professionals. Homebuilder Toll Brothers said the current slump in construction is the worst in 40 years. The National Association of Realtors forecast a drop in home sales of 8% in 2006, with a further decline in 2007. PMI Mortgage Insurance added to the gloom by predicting a 32.8% chance that home prices will fall in the next two years. Source.

Technology provides competitive edge. Part 3: Surviving a real estate downturn. As the housing market slows, budgets tighten, and some buyers and sellers may be clinging to unrealistic interpretations of local market conditions. Real estate agents will find themselves competing harder for clients, especially in a time when consumer Web sites are popping up everyday, giving consumers a sense of empowerment over what they do and do not know. In this four-part series, Inman News examines the effect of the housing slowdown on everyday real estate business. We've asked brokers and agents what they are doing differently with marketing now that listing times are longer, how they are keeping an edge, and how a slowdown may or may not be impacting commission rates. Source.

Zillow: Good Real Estate Idea is a Fixer. A Web site allows buyers and sellers to find value of homes without providing personal info, however data is often inaccurate and incomplete. Zillow isn't the only free, proprietary online real estate site. RealEstateABC.com offers comparable functionality with a few extra features, and similar sites are sure to emerge. Yahoo! Real Estate announced in late July that Zillow would be incorporated into its site as an added functionality tool, and at least one major real estate brokerage, Prudential California/Nevada Realty, announced the incorporation of Zillow within its own website. Source.

To believers, saint moves homes. Real estate cool-down prompts some sellers to buy into burial legend of St. Joseph. Judy Moore knew she was going to have trouble selling the home with the really steep driveway. For help, she turned not to an advertiser or a fellow real estate agent, but to someone she hadn't used since the last slowdown in the housing market: St. Joseph. She buried a figurine of the Roman Catholic saint upside down in the home's yard. And soon, sure enough, she had her sale. Source.

Real Estate Appraising: Chilled, But Not Frozen. It can be tricky to arrive at a valuation in a cooling market. Traditionally, appraisers inspect the property's physical condition, functionality and surrounding neighborhood. Then they compare that property to the comparable recent sales, making adjustments to price estimates for features that are superior or inferior. Some appraisers say the boom provided a temptation to cut corners and complete more appraisals in less time. Now, in cooling markets, the sales prices of the comparable properties may not account for the price drops some neighborhoods have seen. And those selling the homes may be throwing in incentives like cash-back rebates or electronic extras, meaning the effective sale price of the home could be considerably less than the recorded selling price. During the boom, housing was in such demand that buyers would bid each other up, past the seller's asking price. Once a highest bidder was determined, the lender for that bidder's mortgage would send an appraiser to complete a valuation on the property. The appraiser's job in that situation is to make sure the buyer isn't paying dramatically more than the home is worth, so that the lender can avoid lending more money than necessary. Klinge said he thinks the appraisers usually lined their estimates up with where the market was trending -- up. Source.

Home Price Appreciation Slackens. The Southland median rose 2.7% in August, the smallest year-over-year increase since 1999. Even the Inland Empire — one of the nation's fastest-growing economies — is no longer enjoying double-digit gains. The last time each of the six Southland counties posted single-digit increases: December 1999.

Southland home prices have been relatively flat on a month-to-month basis since March. The problem: There simply are more homes available for sale than people willing to buy them at current prices. Sales fell 25.3% to 25,628 in August, the ninth consecutive month of declines and the worst August since 1997. After six years of sizzling price appreciation that doubled Southland home values, potential buyers now appear to be collectively sitting on the sidelines. August was the first month since December 2002 that San Bernardino County, considered the most affordable local housing market, rose at a single-digit growth rate. The median price increased 6.1% to $365,000. Neighboring Riverside County's median rose 7% to $415,000. Sales in the Inland Empire fell more than 20%. Orange County remained the most expensive local region, with a median price of $633,000, a 2.6% gain from the year before. Ventura County's median rose 1% to $598,000. Sales fell 32% in Orange County and dropped 31.8% in Ventura County. Los Angeles County's median, as reported last week, rose 4.7% to $517,000. Source.

Southland home prices have been relatively flat on a month-to-month basis since March. The problem: There simply are more homes available for sale than people willing to buy them at current prices. Sales fell 25.3% to 25,628 in August, the ninth consecutive month of declines and the worst August since 1997. After six years of sizzling price appreciation that doubled Southland home values, potential buyers now appear to be collectively sitting on the sidelines. August was the first month since December 2002 that San Bernardino County, considered the most affordable local housing market, rose at a single-digit growth rate. The median price increased 6.1% to $365,000. Neighboring Riverside County's median rose 7% to $415,000. Sales in the Inland Empire fell more than 20%. Orange County remained the most expensive local region, with a median price of $633,000, a 2.6% gain from the year before. Ventura County's median rose 1% to $598,000. Sales fell 32% in Orange County and dropped 31.8% in Ventura County. Los Angeles County's median, as reported last week, rose 4.7% to $517,000. Source. ~Tina Jan~

Coldwell Banker Kivett-Teeters

1655 E. Sixth St.

Beaumont, CA 92223

Work: 951-845-5520 Ext. 105

Fax: 951-845-4916

Cell: 909-446-2666

Toll-Free: 1-877-TINAJAN

tina.jan@coldwellbanker.com

www.tinajan.com

Friday, September 15, 2006

Real Estate News for Friday, September 15th, 2006

The single-family housing market is sinking. The single-family housing market is sinking in many parts of the country, and the stocks of publicly traded home-building companies have been falling to the basement in tandem. But if you are a real-estate investor, it's not total despair out there. In fact, for publicly traded companies whose primary business is multifamily housing, things are just peachy. Source.

Home buying will stay strong, real estate executive says. Analyze national and local real estate sales — and prices — from a 100-year perspective and recent trends are really very promising, Coldwell Banker leaders said Thursday. In Naples for a two-day company conference at The RitzCarlton Beach Resort, Coldwell Banker President and Chief Executive Officer Jim Gillespie said the real estate market may be a little "off" this year, but the numbers are still impressive. "Some of the (newspaper) headlines don’t really tell the story," Gillespie said. Real estate may be off 7.6 percent from the previous year, but it was coming off the industry’s best year in history, Gillespie said. Source.

Most Commercial Real Estate Sectors Continue to Improve. Most commercial real estate markets can expect tightening vacancy rates and rising rents, and large investors are pouring funds into commercial sectors, according to the latest Commercial Real Estate Outlook of the National Association of Realtors. David Lereah, NAR’s chief economist, said most commercial market fundamentals are solid. "Commercial real estate markets move in response to changes in fundamental demand, which remains solid as a result of sustained job creation and economic growth," he said. "Except for some weakness in the retail sector, the commercial market is benefiting from lower vacancies and higher rents." Institutional investors have been very active in commercial real estate this year. "Large institutional investors such as pension funds and life insurance companies are considered to be cautious and risk adverse, so their shift of funds into commercial sectors is an affirmation of the wisdom of diversification in commercial real estate," Lereah said. Institutional investors and private equity funds accounted for half of all office buildings purchased during the first seven months of 2006, and also purchased one-third of industrial real estate. These institutions spent over $31.0 billion in all of the commercial sectors so far this year, which is seen to be a record for institutional investment in commercial grade properties. Source.

Del Webb tops rankings for customer satisfaction. J.D. Power and Associates has released its annual rankings for customer satisfaction with home builders and Del Webb has topped the list for the third consecutive year. Las Vegas ranked higher than Phoenix but below all of the California markets. Austin ranked No. 1 in the country with a score of 124. The Inland Empire had 116 and Los Angeles and Ventura counties had a 114. Ten factors drive the survey, starting with a builder's warranty and customer service. The remaining categories in order of importance are home readiness; builder's sales staff; construction manager; quality of workmanship and materials; price and value; physical design elements; builder's design center; recreational facilities; and location. Del Webb, a brand of Pulte Homes, scored 142 in the rankings, an improvement of four points over 2005. Pulte Homes' traditional home building operations tied for second at 138 with Centex Homes. That's quite a jump for Centex, which scored 115 in 2005. Beazer had the biggest decline, falling from 101 to 78, KB Home dropped from 130 in 2005 to 111 in this year's rankings. Pardee fell from 114 to 97. What weight, if any, these latest rankings will carry with consumers in this slow housing market, has yet to be seen. Paula Sonkin, executive director of real estate industries practice at J.D. Power, said the rankings will carry more importance with a soft market. Builders are offering incentives to get rid of inventory and struggling with labor issues and increasing building material costs, Sonkin said. "As builders fight for every sale they close in this down turned market, a reputation for customer satisfaction becomes more important than ever, as it helps builders differentiate themselves from the competition," she said. Source.

Housing Bubble and Real Estate Market Tracker. Read articles titled "Rising inventories weigh on home prices," "Housing Still Cooling," etc. Source.

The Home Buying Process: Step by Step. Buying a home can be a very intimidating process, especially if you've never done it before. So the first thing you should do before you start the home buying process is to figure out whether owning a home is right for you. It may or may not be and this decision depends on you and what your circumstances are. If you're in a region where housing is at a real premium or is very expensive (such as New York or California), it may be better for you to continue renting. Take into account that if you do buy a home, there are extra responsibilities and costs that go along with owning a home-such as lawn care, snow removal, home maintenance and repairs, etc. So, if you've decided that renting is no longer for you and you want to move into your own home, you may ask, Where do I begin?

Step 1: Check Your Credit Report and Score

Step 2: Figure Out How Much You Can Afford

Step 3: Find the Right Lender and Real Estate Agent

Step 4: Look for the Right Home

Step 5: Make an Offer for the Home

Step 6: Get the Right Mortgage for Your Situation

Step 7: Close On Your Home

Step 8: Move In!

Source.

Building or buying a new home? Think modular. It's a buyer's market for real estate. But a buyer's market doesn't make it any cheaper, easier or faster to build a home. As construction costs escalate and building codes become more complex, it's harder to keep up. And what about the strain on you and your family? You have to be project manager, design lead, financial coordinator, and people manager ... all harder if you're trying to do it remotely; all harder if you don't know much about building homes. Source.

Real Estate Recession Coming. The housing market now is increasingly a buyer's market. One of the major builders of luxury homes reported that both its third quarter and full year earnings "would fall short of its previous forecasts as a result of slower sales." The firm noted that "high cancellation rates on contracts in backlog that were projected to close this year, and more pronounced use of price concessions and incentives, particularly on the resale of those homes which have experienced contract cancellations." Some realtors and economists now argue that the decline in home prices will be modest and is nearly complete. Source.

What's Really Propping Up The Economy. Since 2001, the health-care industry has added 1.7 million jobs. The rest of the private sector? None. But the very real problems with the health-care system mask a simple fact: Without it the nation's labor market would be in a deep coma. Since 2001, 1.7 million new jobs have been added in the health-care sector, which includes related industries such as pharmaceuticals and health insurance. Meanwhile, the number of private-sector jobs outside of health care is no higher than it was five years ago. Sure, housing has been a bonanza for homebuilders, real estate agents, and mortgage brokers. Together they have added more than 900,000 jobs since 2001. But the pressures of globalization and new technology have wreaked havoc on the rest of the labor market: Factories are still closing, retailers are shrinking, and the finance and insurance sector, outside of real estate lending and health insurers, has generated few additional jobs. Source.

Housing market in LA, San Diego counties keeps slowing. The once-high flying housing market kept slowing in August in two key Southern California counties, as sales eroded and prices lagged compared to a year ago, a real estate research firm said. Data released Wednesday for Los Angeles and San Diego counties suggested a price correction was under way in the markets that had attracted bidding wars in recent years, said Andrew LePage, an analyst with DataQuick Information Systems. "We're not sure at what point demand will respond and start to pick up again," he said. In Los Angeles County, home prices rose in August at the lowest annual rate in six years. In San Diego County, prices declined 2.2 percent compared to the year-ago figure, the data showed. Figures for other California counties were due next week. Last month, 9,193 homes were sold in Los Angeles County, a 21 percent drop from the same time last year and the fewest for the month of August since 1997. It was the county's ninth straight month of plunging year-over-year sales. Meanwhile, the median price in the county increased 4.7 percent in August to $517,000, the data showed. The situation was worse in San Diego County, where the median price of a home dropped to $482,000, the same level as April 2005. The county also saw a 32 percent decline in sales compared to a year ago. Analysts said the drop in sales could bottom out by the middle of next year and make a gradual recovery by late 2008. "It will take a year or two to work itself out," said Alan Gin, a University of San Diego professor and associate at its Burnham-Moores Center for Real Estate. Source.

National Foreclosures Increase 24 Percent in August According to RealtyTrac(TM) U.S. Foreclosure Market Report. Foreclosures Up Nearly 53 Percent From August 2005, 38 Percent Year-to-Date. "After spiking early in the year U.S. foreclosure activity has been relatively flat over the last few months. But foreclosures ramped up significantly in August, pushing the national foreclosure rate close to its highest level of the year so far," said James J. Saccacio, chief executive officer of RealtyTrac. "And with home price appreciation continuing to decelerate and billions of dollars in adjustable rate mortgages projected to reset in the next few months, this month's increase could be the beginning of an upward shift in the foreclosures market." The five states with the most new foreclosure filings -- Florida, Texas, California, Ohio and Illinois -- accounted for 50 percent of the nation's foreclosure activity in August. With 12,506 properties entering some stage of foreclosure, California foreclosures increased nearly 25 percent from the previous month, and the state's foreclosure rate -- one new foreclosure filing for every 977 households -- registered slightly above the national average for the third month in a row. Source.